Giuseppe Sandro Mela.

2023-02-06.

«è principalmente destinato all’alimentazione degli animali domestici, sotto forma di granella, farine o altri mangimi, oppure come insilato, generalmente raccolto alla maturazione cerosa; è inoltre destinato a trasformazioni industriali per l’estrazione di amido e olio oppure alla fermentazione»

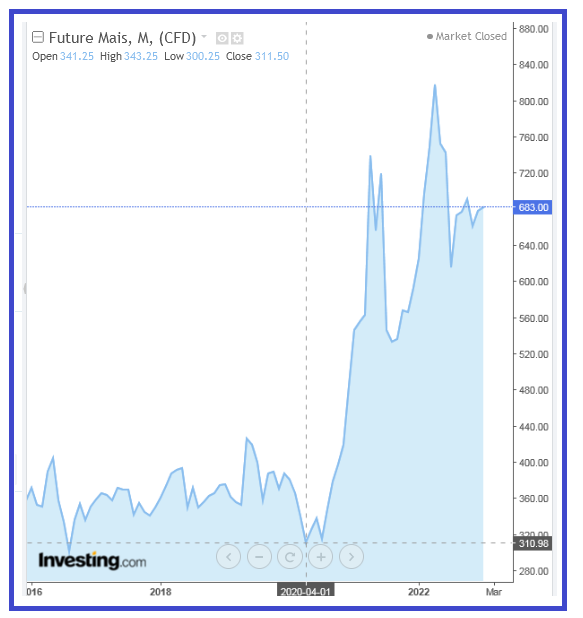

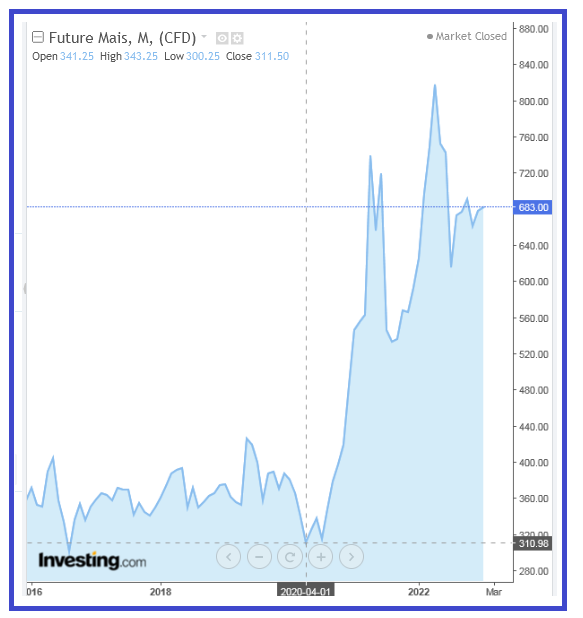

La crisi della produzione del mais si ripercuote duramente su tutta la filiera alimentare.

* * * * * * *

«Il mais (Zea mays L., 1753), anche chiamato granturco o granoturco, è una pianta erbacea annuale della famiglia delle graminacee, tribù delle Maydeae: addomesticato dalle popolazioni indigene in Messico centrale in tempi preistorici circa 10,000 anni fa, è uno dei più importanti cereali, largamente coltivato sia nelle regioni tropicali sia in quelle temperate, in quest’ultimo caso a ciclo primavera-estate.

Base alimentare tradizionale delle popolazioni dell’America Latina e di alcune regioni dell’Europa e del Nordamerica, nelle regioni temperate è principalmente destinato all’alimentazione degli animali domestici, sotto forma di granella, farine o altri mangimi, oppure come insilato, generalmente raccolto alla maturazione cerosa; è inoltre destinato a trasformazioni industriali per l’estrazione di amido e olio oppure alla fermentazione, allo scopo di produrre per distillazione bevande alcoliche o bioetanolo a scopi energetici.

L’infiorescenza femminile, che porta le cariossidi, si chiama correttamente spadice, ma viene più spesso impropriamente chiamata “pannocchia”, mentre la pannocchia propriamente detta è l’infiorescenza maschile posta sulla cima del fusto (stocco) della pianta, che di contro viene talvolta chiamata impropriamente “spiga” per il suo aspetto. Le cariossidi sono fissate al tutolo e il tutolo è fissato alla pianta.» [Fonte]

Nel 2020 la produzione mondiale di mais ammontava a 1,162.4 milioni di tonnellate: Stati Uniti 360.3, Cina 260.7, Brasile 104.0, Argentina 58.4, Ukraina 30.3, India 30.2, Messico 27.4, Indonesia 22.5, Sud Africa 15.3, Russia 13.9.

La produzione mondiale di mais supera il miliardo di tonnellate all’anno. È la principale materia prima che compone i becchimi ed è utilizzato dalla industria degli amidi.

Stati Uniti e Cina producono insieme il 58% del totale mondiale.

Si noti però come vi siano profonde differenze nella resa, che negli Stati Uniti ammonta a 10,960.4 kg per ettaro, contro i 3,718.1 del Messico, ed i 5,947.7 della Cina.

La siccità dello scorso anno ne ha falcidiato la produzione squinternandone tutta la filiera alimentare.

I cambiamenti climatici “uccidono” il mais: campi coltivati al minimo storico

«I cambiamenti climatici mettono a rischio l’agricoltura, e questo non è una novità. Ma ora, in particolare, i riflettori sono puntati sul mais, dove il calo delle superfici coltivate scese al minimo storico di 564mila ettari e il pessimo andamento climatico dell’annata caratterizzato da una siccità estiva senza precedenti, hanno ridotto la produzione italiana ad appena 4,7 milioni di tonnellate, la stessa del 1972, con gravi problemi anche di qualità»

* * * * * * *

Aree in cui il mais cresce ed è meglio coltivato in Russia e nel mondo.

Il mais è oggi una delle principali colture alimentari, foraggere e industriali. È la pianta da pane più antica del nostro pianeta. Molti Paesi del mondo in cui cresce il mais sono esportatori di questa coltura.

La patria del mais selvatico è l’America centrale e meridionale. Il grano fu portato in Europa da Colombo nel 1496. La cultura è arrivata in Russia durante la guerra russo-turca del 1768-1774. La sua diffusione in tutto il Paese è iniziata in Bessarabia, dove il mais veniva coltivato ovunque.

In Turchia il mais è chiamato “kokoroz”, una pianta alta. Grazie a N. Krusciov, negli anni ’60 del secolo scorso è iniziato nel nostro Paese l’allevamento attivo della coltura. Grazie all’allevamento di un gran numero di varietà zonate e di ibridi, la coltivazione del mais è oggi praticata in Siberia, negli Urali e nell’Estremo Oriente.

In Russia il mais viene coltivato per la produzione di cereali e di foraggio verde. Il principale vantaggio della coltura è la resa: il mais può produrre 4,5 e più tonnellate di cereali e 17 tonnellate di massa verde da un ettaro. I chicchi di mais vengono utilizzati per produrre farina, amido, etanolo, destrina, glucosio, sciroppo, olio e vitamina E. Vengono inscatolati, trasformati in cereali e fiocchi e utilizzati per la produzione di mangimi composti.

Il mais è una coltura erbacea annuale alta. Il fusto può raggiungere un’altezza di 3 m o più. Oggi sono ampiamente coltivate anche varietà sottodimensionate. Lo stelo può raggiungere i 7 cm di diametro. Le foglie sono grandi, lunghe circa 1 m e larghe 10 cm, lineari-lanceolate. Su un fusto possono esserci da 8 a 42 foglie.

La pianta ha un apparato radicale potente e ben sviluppato che penetra nel terreno a una profondità di 1 m o più. Le radici possono formarsi anche sui nodi inferiori dello stelo, per fornire alla pianta ulteriore umidità e sostanze nutritive, oltre che sostegno.

Il mais è una pianta monoica, impollinata dal vento, quindi i suoi fiori sono unisessuali: i maschi formano pannocchie in cima agli steli, mentre le femmine formano pannocchie situate all’ascella delle foglie. La resa dipende dalla varietà. Il mais su un germoglio può formare 1-2 pannocchie (o più) di 4-50 cm di lunghezza e 2-10 cm di diametro.

Il peso della pannocchia può essere di 30-500 g. Le pannocchie sono chiuse in involucri simili a foglie e solo le lunghe colonne pistillari fuoriescono. Il vento trasferisce il polline dalle infiorescenze maschili ai pistilli delle pannocchie, sui quali, dopo la fecondazione, si formano i frutti – le cariossidi. L’autoimpollinazione della pianta è impossibile. Le piccole aree possono richiedere la raccolta manuale del polline e l’impollinazione.

Le cariossidi hanno una forma cubica o arrotondata, sono piantate strettamente l’una all’altra e si trovano sul gambo delle pannocchie in file. 1 pannocchia può contenere fino a mille chicchi. Nella maggior parte dei casi i frutti sono gialli, ma esistono anche varietà con grani rossi, viola, blu e persino neri.

Per imparare a distinguere le varietà, si può utilizzare la descrizione e la foto presentata sulla confezione dei semi; la coltivazione del mais, a seconda della varietà, dura 90-150 giorni. Le piantine compaiono 10-12 giorni dopo che i semi sono stati piantati nel terreno. Inizialmente si tratta di una coltura termofila che germina a 8 … 10 ºС e si sviluppa a 20 … 24 ºС.

Esiste un gran numero di varietà e ibridi zonali e adattati con un breve periodo di crescita. Sono in grado di crescere e fruttificare nel clima freddo della Siberia e di altre regioni a temperature più basse e resistono a gelate fino a -3 ºС.

Il mais è una coltura che ama la luce. L’illuminazione è particolarmente importante all’inizio della stagione di crescita. Pertanto, il metodo di semina ottimale è il nido quadrato, in cui l’oscuramento dei germogli reciproci è minimo.

Il mais dipende dall’aerazione del suolo. L’allentamento e altre lavorazioni del terreno sono necessarie per ottenere un buon raccolto. La coltura dipende dall’assunzione di umidità. Nella stagione calda, una pianta può assorbire più di 1 litro d’acqua.

Un grande volume di massa verde e un alto contenuto di monosaccaridi coinvolti nella fermentazione del latte durante l’insilamento è il motivo per cui il mais è la principale coltura insilata nel nostro Paese.

Il mais viene definito coltura a file. Nella rotazione delle colture, prende il posto del predecessore delle colture di cereali e leguminose o di un impianto a vapore quando viene coltivato per il foraggio verde.

Nonostante la pianta impoverisca notevolmente il suolo e ne degradi la struttura, lo libera dalle erbacce, da molte malattie e dai parassiti. Nel sud del Paese, il mais viene seminato in colture ripetute.

Le principali aree di coltivazione del mais da granella per la produzione di mangimi e per l’industria alimentare sono l’Asia centrale, la Transcaucasia, il Caucaso settentrionale, la regione della Terra Nera centrale e la regione del Volga. Ciò è dovuto al fatto che i terreni migliori per la coltivazione sono fertili: terra nera, terreni fluviali alluvionali e terreni strutturali dei campi. Il mais può crescere su argille sabbiose, argille grigio scuro e torbiere. La pianta si sviluppa e fruttifica male su terreni argillosi, acquitrinosi, salini e acidi.

Il mais da foraggio verde è meno capriccioso e quindi viene coltivato ovunque, anche nella Regione della Terra non Nera, su terreni di torbiera e di zolla.

La coltura richiede un terreno con una reazione neutra dell’ambiente; sono accettabili anche terreni leggermente acidi. Per coltivare il mais su terreni podzolici e acidi, prima della semina si aggiungono dolomite, cenere di legno e fertilizzanti organici (humus, compost, torba). Con un’applicazione sufficiente di fertilizzanti organici e minerali, il mais può essere coltivato su terreni sabbiosi.

A causa delle peculiarità dell’apparato radicale, la pianta necessita di terreni sciolti con una buona aerazione, arricchiti di ossigeno.

Sui terreni contaminati da erbe infestanti, in particolare l’amaro rosa, la gramigna strisciante, il cardo da semina e altre erbacce che succhiano rizomi e radici, il mais cresce male. Questo aspetto è particolarmente importante nella fase di emergenza.

Quando si coltivano cereali per l’industria alimentare, il terreno deve avere abbastanza fosforo, potassio, calcio, zolfo, ferro, magnesio, manganese, boro, cloro, iodio, zinco, rame e altre sostanze.

La composizione minerale del terreno è della massima importanza all’inizio della stagione di crescita, così come nella fase di formazione delle spighe e di maturazione del latte dei cereali. L’applicazione tempestiva di fertilizzanti organici e minerali è una condizione importante per ottenere una resa elevata e una granella di mais di alta qualità per l’industria alimentare.

Nella prima metà della stagione di crescita, la pianta ha bisogno soprattutto di azoto, fosforo e potassio, e dopo l’inizio della fioritura, di fosforo e potassio. Un eccesso di azoto ritarda la formazione dei chicchi.

Quanto tempo cresce il mais?

La durata del periodo di crescita del mais dipende dalla varietà o dall’ibrido della pianta. Può durare da 90 a 150 giorni. Poiché la Russia è al 95% un’area di coltivazione rischiosa, le varietà a maturazione precoce sono le più popolari. In questo caso, il chicco ha il tempo di maturare prima dell’arrivo del freddo.

Negli Urali, quando si semina in piena terra, anche le varietà più precoci non hanno il tempo di maturare, quindi il mais viene coltivato qui per il foraggio verde. Per ottenere cereali, si pratica la coltivazione preliminare delle piantine, ma questo metodo non viene utilizzato in grandi volumi. Le piantine vengono piantate a partire dalla seconda metà di maggio. Il raccolto avviene in agosto-settembre.

Per la coltivazione del mais nella regione del Nord-Ovest e, in particolare, nella regione di Leningrado, si utilizzano ibridi di prima generazione (F1 Candle, Spirit, Trophy e altri) con un breve periodo di crescita, le cui spighe maturano 70-75 giorni dopo la germinazione. Per le piccole aree, si utilizza il metodo di coltivazione delle piantine. Nella parte meridionale della regione si possono coltivare varietà con un periodo di maturazione di 90-100 giorni. Il mais coltivato nella regione di Pskov viene seminato all’aperto a maggio e raccolto nelle prime settimane di settembre.

Il mais può crescere senza l’intervento dell’uomo?

Il genere mais comprende 6 specie di piante, ma solo una di esse – il mais da zucchero adatto al consumo umano. Non esistono varietà selvatiche che possano crescere senza una coltivazione preliminare del terreno in campo aperto.

Nelle aree abbandonate è possibile trovare piante che crescono da sole. In questo caso, i semi delle pannocchie non raccolte o troppo mature e fuoriuscite germogliano senza lavorazione del terreno, in campo aperto.

Nel corso del tempo, con la ripetuta auto-semina, le proprietà caratteristiche della varietà si perdono e l’uso di questo mais diventa possibile solo per l’alimentazione degli animali da allevamento. Le condizioni necessarie per la piena maturazione del chicco sono rare in questo caso.

Dove cresce il mais: i Paesi produttori.

Il mais viene coltivato con successo variabile in molti Paesi del mondo con climi adatti e condizioni create dalla natura e dall’uomo. La maggior parte degli Stati del continente americano, dell’Asia e dell’Europa sono leader nella produzione di cereali.

Secondo l’Organizzazione delle Nazioni Unite per l’Alimentazione e l’Agricoltura, l’Ucraina (6° posto) e la Russia (9° posto) sono tra i leader nella produzione e nell’esportazione di mais. Gli Stati membri dell’Unione Europea raccolgono circa il 6,5% della produzione mondiale di mais, mentre i membri della CSI producono insieme solo il 4,6%.

Paesi esportatori di mais

Il ruolo di leader nella produzione di mais spetta agli Stati Uniti. In questo Paese si producono più di 380 mila tonnellate di mais all’anno.

Altri paesi produttori di mais (secondo l’Organizzazione delle Nazioni Unite per l’alimentazione e l’agricoltura) sono:

Cina (oltre 230 mila tonnellate).

Brasile (oltre 64 mila tonnellate).

Argentina (oltre 39,5 mila tonnellate).

Messico (circa 28 mila tonnellate).

Ucraina (circa 28 mila tonnellate).

In quale Paese il mais cresce meglio?

Poiché la patria storica del mais è il Messico e la costa caraibica, la coltura cresce meglio in Paesi con climi e terreni simili. Inoltre, solo negli Stati Uniti, in Canada e in Francia, che sono tra i primi dieci principali esportatori di mais, la resa del raccolto è elevata. Nel resto dei Paesi, i volumi si ottengono aumentando la superficie coltivata.

Tra i Paesi che commerciano mais nel mondo, la resa migliore è quella della Grecia – 13,5 t/ha, i Paesi Bassi – 11,8 t/ha; allo stesso tempo, la resa media nei Paesi dell’UE nel 2017 è stata di sole 6,91 t/ha. Negli Stati Uniti si raccolgono circa 10 tonnellate di grano per ettaro e, allo stesso tempo, la resa cresce ogni anno di almeno l’1%. Lo stesso vale per l’Europa occidentale.

In Russia, nonostante le condizioni sfavorevoli nella maggior parte del territorio, la resa rientra nell’intervallo globale – 5,6 t/ha. In Cina, invece, si registra una tendenza al ribasso delle rese.

Il buon mais sta crescendo nella sua terra d’origine: Messico, Brasile, Argentina. Questi Paesi producono ed esportano granella e farina di mais.

Dove cresce il mais in Russia?

Un’ampia scelta di ibridi e varietà zonali permette di seminare mais in molte regioni della Federazione Russa. Fondamentalmente, le colture di cereali sono coltivate nel Caucaso settentrionale, nella regione del Volga, nella regione centrale della Terra Nera, nelle regioni meridionali dell’Estremo Oriente e della Siberia e in altre regioni. E per l’insilamento e il foraggio verde – quasi ovunque, ad eccezione delle regioni dell’estremo nord e della Regione economica settentrionale. La superficie totale coltivata è di circa 3 milioni di ettari.

Le zone calde di terra nera sono le migliori per la coltivazione e la Federazione Russa, nonostante le caratteristiche climatiche, è tra i leader nella produzione e nell’esportazione di mais nel mondo. Il Territorio di Krasnodar è il primo dei cinque principali produttori di mais.

Oggi in Russia la superficie coltivata è di circa 2800 mila ettari.

Dove cresce il mais da granella in Russia

Le principali aree di coltivazione del mais nella Federazione Russa:

Territorio di Krasnodar (3368 mila tonnellate – 34% del volume lordo di cereali).

Territorio di Stavropol (932 mila tonnellate – 9,5%).

Regione di Belgorod (747 mila tonnellate – 7,6%).

Regione di Rostov (632 mila tonnellate – 6,4%).

Regione di Kursk (529 mila tonnellate – 5,4%).

Voronezh (518 mila tonnellate – 5,3%).

I terreni e le condizioni climatiche di queste aree sono ottimali per la coltivazione del mais.

Più dell’1% del volume totale è prodotto da aree di coltivazione del mais russo come Kabardino-Balkaria, le repubbliche del Tatarstan e dell’Ossezia del Nord, le regioni di Tambov, Lipetsk, Saratov e Mordovia.

I migliori indicatori di resa sono stati registrati nelle regioni di Mosca (70.6 c/ha), Kaliningrad (67.4 c/ha) e Oryol (63.7 c/ha).

* * * * * * *

Clima 2022 flagella il mais, superfici giù a minimo storico.

27 gennaio 2023.

* * * * * * *

27 GEN – Riflettori puntati sul mais, dove il calo delle superfici coltivate scese al minimo storico di 564 mila ettari e il pessimo andamento climatico dell’annata caratterizzato da una siccità estiva senza precedenti, hanno ridotto la produzione italiana ad appena 4,7 milioni di tonnellate, la stessa del 1972, con gravi problemi anche di qualità.

E’ la situazione del settore tracciata nel consueto appuntamento organizzato dal Crea Cerealicoltura e Colture Industriali, con un focus dedicato alla Pac 2023-27. “Il mais è una delle colture che più risentono delle mutate condizioni del clima – afferma il direttore del Centro, Nicola Pecchioni – per questo motivo il futuro della coltura sarà sempre più legato alla vocazione dei territori, alla disponibilità della risorsa idrica e all’agricoltura di precisione”.

In base ai primi dati Istat, i rendimenti unitari sono crollati del 23%, con cali di resa fino al 32% in Veneto e al-25% in Lombardia, tra le maggiori regioni maidicole, e punte del 43% a Rovigo e del 46% a Perugia. Un andamento negativo che ha coinvolto tutti i produttori europei con una diminuzione di 21 milioni di tonnellate nella sola Ue (-29%). L’emergenza climatica del 2022, tra siccità, a funghi e micotossine, in particolare aflatossine, che ha pregiudicato quantità e qualità della produzione, ha reso evidente l’urgenza di migliorare la sostenibilità e la resilienza dei sistemi colturali. I risultati del monitoraggio della Rete Qualità Mais, coordinata dal Crea, ha evidenziato che il 26% dei campioni presenta un contenuto in aflatossine superiore ai 20 µg/kg e il 65% con fumonisine maggiori di 4000 µg/kg. Lo sviluppo di resistenze e/o tolleranze agli stress passa necessariamente attraverso il miglioramento genetico e la scelta delle varietà più idonee a tali scopi. Non ultimo il settore ora dovrà fare i conti con le nuove regole previste dalla nuova Pac, spiega il Crea, con un taglio del 40% degli aiuti diretti; l’importo del contributo, infatti, si dimezzerà dagli attuali 360 euro/ettaro a 180 euro/ettaro, arrivando a 255 euro/ettaro solo nel caso in cui si aderisse all’ecoschema, i nuovi criteri fissati sul fronte della sostenibilità.

* * * * * * *

Areas where corn grows and is best grown in Russia and the world.

Corn or maize is one of the leading food, forage and industrial crops today. This is the oldest bread plant on our planet. Many countries of the world where corn grows are grain exporters of this crop.

The homeland of wild maize is Central and South America. Grain was brought to Europe by Columbus back in 1496. Culture came to Russia during the Russian-Turkish war in 1768-1774. Its spread throughout the country began in Bessarabia, where maize was cultivated everywhere.

In Turkey, maize is called “kokoroz” – a tall plant. Thanks to N. Khrushchev, active breeding of culture began in our country in the 60s of the last century. Due to the breeding of a large number of zoned varieties and hybrids, the cultivation of corn is now practiced in Siberia, the Urals, and the Far East.

Corn in Russia is cultivated for grain and green forage. The main advantage of culture is yield: corn can produce 4.5 and more tons of grain and 17 tons of green mass from 1 hectare. Corn grain is used to produce flour, starch, ethanol, dextrin, glucose, syrup, oil, and vitamin E. It is canned, processed into cereals and flakes, and used for the production of compound feed.

Corn is a tall, annual herbaceous crop. The stem can reach a height of 3 m or more. Today, undersized varieties are also widely cultivated. The stem can reach 7 cm in diameter. The leaves are large, about 1 m long and 10 cm wide, linear-lanceolate. There can be from 8 to 42 leaves on 1 stem.

The plant has a powerful, well-developed root system that penetrates the soil to a depth of 1 m or more. Roots can also form on the lower nodes of the stem – to provide the plant with additional moisture and nutrients, as well as support.

Maize is a monoecious, wind-pollinated plant, so its flowers are unisexual: males form panicles at the top of the stems, and females form cobs located in the axils of the leaves. The yield is determined depending on the variety. Corn on 1 shoot can form 1-2 cobs (or more) 4-50 cm long and 2-10 cm in diameter.

The weight of the cob can be 30-500 g. The cobs are sealed in leaf-like wrappers, and only long pistillate columns come out. The wind transfers pollen from male inflorescences to the pistils of the ears, on which, after fertilization, fruits – caryopses – are formed. Self-pollination of the plant is impossible. Small areas may require manual pollen collection and pollination.

The caryopses have a cubic or rounded shape, they are planted tightly to each other and are located on the stem of the cobs in rows. 1 cob can contain up to 1 thousand grains. In most cases, the fruits are yellow, but there are also varieties with red, purple, blue and even black grains.

In order to learn how to distinguish between varieties, you can use the description and photo presented on the package with seeds; the cultivation of maize, depending on the variety, lasts 90-150 days. Seedlings appear 10-12 days after the seeds are embedded in the soil. Initially, it is a thermophilic culture that germinates at + 8 … 10 ºС and develops at + 20 … 24 ºС.

There are a large number of zoned and adapted varieties and hybrids with a short growing season. They are able to grow and bear fruit in the cold climate of Siberia and other regions at lower temperatures and withstand frosts down to -3 ºС.

Corn is a light-loving crop. Illumination is especially important at the beginning of the growing season. Therefore, the optimal sowing method is a square-nest, in which the darkening of each other’s shoots is minimal.

Maize is dependent on soil aeration. Loosening and other processing of the soil is necessary to obtain a good harvest. The culture is dependent on moisture intake. In hot weather, 1 plant can absorb more than 1 liter of water.

A large volume of green mass and a high content of monosaccharides involved in milk fermentation during ensiling is the reason that corn is the main silage crop in our country.

Maize is referred to as row crops. In the crop rotation, it takes the place of the predecessor of grain and leguminous crops or a steam planting when grown for green fodder.

Despite the fact that the plant greatly depletes the soil and degrades its structure, it frees it from weeds, many diseases and pests. In the south of the country, corn is sown in repeated crops.

The main areas for the cultivation of maize for grain for the production of animal feed and for the food industry are Central Asia, Transcaucasia, the North Caucasus, the Central Black Earth region and the Volga region. This is due to the fact that the best soils for growing crops are fertile: black soil, floodplain river and structural field soils. Corn can grow on sandy loams, dark gray loams and peat bogs. The plant develops and bears fruit poorly on heavy clay, waterlogged, salty and acidic soils.

Corn for green fodder is less whimsical, and therefore is cultivated everywhere, including in the Non-Black Earth Region, on peat bog and sod-podzolic soils.

The culture requires a soil with a neutral reaction of the environment, slightly acidic soils are also acceptable. To grow maize on podzolic, acidic soils, dolomite, wood ash and organic fertilizers (humus, compost, peat) are added before planting. With sufficient application of organic and mineral fertilizer corn can be grown on sandy soil.

Due to the peculiarities of the root system, the plant needs loose soils with good aeration, enriched with oxygen.

On soils contaminated with weeds, especially pink bitterness, creeping wheatgrass, sow-thistle, and other rhizome and root-sucking weeds, corn grows poorly. This is especially important at the stage of emergence.

When growing grain for the food industry, the soil should have enough phosphorus, potassium, calcium, sulfur, iron, magnesium, manganese, boron, chlorine, iodine, zinc, copper and other substances.

The mineral composition of the soil is of the greatest importance at the beginning of the growing season, as well as at the stage of ear formation and milk ripeness of grain. Timely application of organic and mineral fertilizing is an important condition for obtaining a high yield and high-grade corn grain for the food industry.

In the first half of the growing season, the plant especially needs nitrogen, phosphorus and potassium, and after the beginning of flowering, phosphorus and potassium. Excess nitrogen retards grain formation.

How long does corn grow?

The length of the growing season for maize depends on the variety or hybrid of the plant. It can last from 90 to 150 days. Since Russia is 95% an area of risky farming, early maturing varieties are the most popular. In this case, the grain has time to ripen before the onset of cold weather.

In the Urals, when sown in open ground, even the earliest varieties do not have time to ripen, so maize is cultivated here for green fodder. To obtain grain, they practice preliminary cultivation of seedlings, however, this method is not used in large volumes. Seedlings are planted from the second half of May. Harvesting occurs in August-September.

For the cultivation of corn in the North-West region and, in particular, in the Leningrad region, hybrids of the first generation (F1 Candle, Spirit, Trophy and others) with a short growing season are used, the ears of which ripen 70-75 days after germination. For small areas, use the seedling cultivation method. In the southern part of the region, varieties with a ripening period of 90-100 days can be cultivated. Corn grown in the Pskov region is sown outdoors in May and harvested in the first weeks of September.

Can corn grow without human intervention?

The genus corn includes 6 plant species, but only 1 of them – sugar corn suitable for human consumption. There are no wild-growing varieties that can grow without preliminary cultivation of the land in the open field.

In abandoned areas, you can find plants growing on their own. In this case, seeds from unharvested or overripe and spilled cobs germinate without tillage, in the open ground.

Over time, with repeated self-sowing, the characteristic properties of the variety are lost, and the use of such corn becomes possible only for feeding farm animals. The conditions necessary for the full ripening of the grain are rare in this case.

Where does corn grow: producing countries.

Corn is cultivated with varying success in many countries of the world with suitable climates and conditions created by both nature and man. Most of the states of the American continent, Asia and Europe are leaders in grain production.

According to the UN Food and Agriculture Organization, Ukraine (6th place) and Russia (9th place) are among the leaders in the production and export of corn. The member states of the European Union collect about 6.5% of the world’s total corn production, while the CIS members jointly produce only 4.6%.

Exporting countries of corn

The leading role in the production of maize belongs to the United States. More than 380 thousand tons of corn grain is produced in this country annually.

Other top corn growing countries (according to the UN Food and Agriculture Organization):

China (over 230 thousand tons).

Brazil (over 64 thousand tons).

Argentina (over 39.5 thousand tons).

Mexico (about 28 thousand tons).

Ukraine (about 28 thousand tons).

Which country does corn grow best in?

Since the historical homeland of maize is Mexico and the Caribbean coast, the crop grows best in countries with similar climates and soils. Moreover, only in the USA, Canada and France, which are among the top ten leading exporters of corn grain, there is a high crop yield. In the rest of the countries, the volumes are achieved by increasing the cultivated area.

Among the countries that trade in maize in the world, the best yield is in Greece – 13.5 t / ha, the Netherlands – 11.8 t / ha; at the same time, the average yield in the EU countries in 2017 was only 6.91 t / ha. In the USA, about 10 tons of grain are harvested per hectare.At the same time, the yield grows per year by at least 1%. The same applies to Western Europe.

In Russia, despite unfavorable conditions in most of the territory, the yield is within the global range – 5.6 t / ha. And in China, there is a downward trend in yields.

Good corn is growing in their original homeland: Mexico, Brazil, Argentina. These countries produce and export corn grits and flour.

Where does corn grow in Russia?

A large selection of zoned hybrids and varieties allows sowing corn in many regions of the Russian Federation. Basically, grain crops are grown in the North Caucasus, the Volga region, the Central Black Earth Region, the southern regions of the Far East and Siberia, and in other regions. And for silage and green fodder – almost everywhere, with the exception of the extreme northern regions and the Northern Economic Region. The total area under crops is about 3 million hectares.

Warm black earth areas are the best for cultivation, and the Russian Federation, despite the climatic features, is among the leaders in the production and export of maize in the world. Krasnodar Territory is the first in the five leading corn grain producers.

Today in Russia the area of cultivation of crops is about 2800 thousand hectares.

Where does grain corn grow in Russia

The main areas of corn growing in the Russian Federation:

Krasnodar Territory (3368 thousand tons – 34% of the gross grain volume).

Stavropol Territory (932 thousand tons – 9.5%).

Belgorod region (747 thousand tons – 7.6%).

Rostov region (632 thousand tons – 6.4%).

Kursk region (529 thousand tons – 5.4%).

Voronezh (518 thousand tons – 5.3%).

The soils and climatic conditions in these areas are optimal for growing maize.

More than 1% of the total volume is produced by such areas of Russian corn growing as Kabardino-Balkaria, the republics of Tatarstan and North Ossetia, Tambov, Lipetsk, Saratov regions, Mordovia.

The best yield indicators were recorded in the Moscow (70.6 c / ha), Kaliningrad (67.4 c / ha) and Oryol (63.7 c / ha) regions.