Giuseppe Sandro Mela.

2023-08-03.

«is not authorized to issue international rulings or verdicts»

Una traduzione in lingua italiana è riportata in calce

* * * * * * *

Cina. Rifiuta di biasimare la Russia ed incolpa gli Stati Uniti di quanto accade in Ukraina.

Cina. Acre requisitoria agli Stati Uniti che hanno causato il conflitto russo-ukraino.

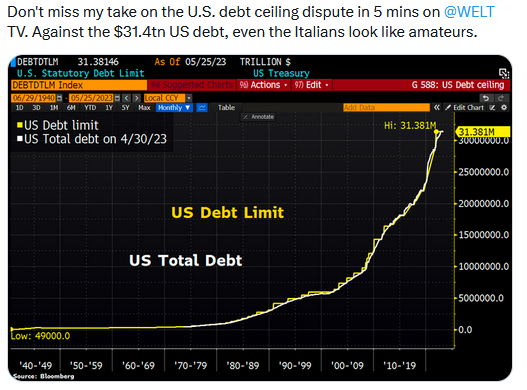

Usa. Le sanzioni hanno ghettizzato il dollaro nell’enclave liberal socialista.

Brics surclassano economicamente i G7. 40.23% contro 29.08% del gdp mondiale.

Kamala Harris. La sublime capacità americana di inimicarsi i paesi africani a favore della Cina.

Cina riduce le riserve in dollari a 859.4 miliardi. Fine del petrodollaro e del dollaro.

Cina, Russia e Blocco Euroasiatico. Con il 40% del pil mondiale vogliono scalzare il dollaro.

Svizzera. Le sanzioni causano l’esodo della ricchezza cinese. Banchieri disperati.

Usa. Malcelato terrore per l’accordo diplomatico tra Arabia Saudita ed Iran.

India. L’accordo con la Russia sul petrolio pagato in rubli scalza il dollaro.

Macron ha decretato la fine della Franceafrique. Subentrano Russia e Cina.

India. L’accordo con la Russia sul petrolio pagato in rubli scalza il dollaro.

Biden. La debolezza della leadership americana è un regalo a Cina, Russia ed Iran.

Usa. Biden non riesce a fermare la Russia. Le sanzioni sono inutili e dannose. – Bloomberg.

Usa. Le sanzioni di Joe Biden hanno generato un possente mercato dello Yuan.

Arabia Saudita. Ha chiesto di aderire al Gruppo Brics. Calcio nei denti a Joe Biden.

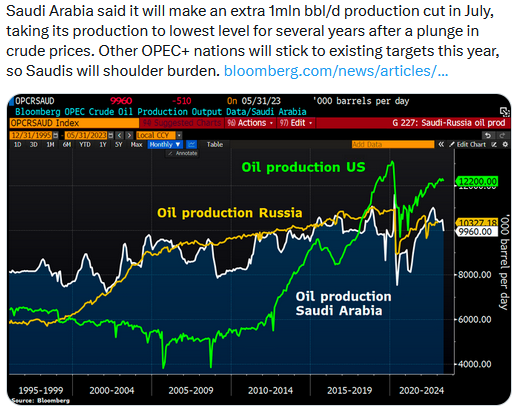

Arabia Saudita. Russia e Cina rimpiazzano gli Stati Uniti nel patto petrolifero.

Intelligence Leak. Gli alleati non possono più fidarsi della America.

China-brokered Iran-Saudi deal raises red flags for US.

* * * * * * *

«American Thinker: anti-Russian sanctions turned out to be the largest miscalculation of the West in history. Sanctions have not brought Russia’s economy to its knees, as many predicted. Russia is gaining more influence and authority in Asia, Africa and South America than it has ever had since the collapse of the Soviet Union. The Russian economy will grow faster than the British or German and may overtake other countries»

«Western countries will struggle with energy shortages and inflation. The International Monetary Fund (IMF) has improved its forecast for Russia’s GDP growth this year to 0.7%.»

* * * * * * *

17/4/2023.

Sanctions have not brought Russia’s economy to its knees, as many predicted. Russia is gaining more influence and authority in Asia, Africa and South America than it has ever had since the collapse of the Soviet Union. The International Monetary Fund (IMF) has improved its forecast for Russia’s GDP growth this year to 0.7%.Russian Prime Minister Mikhail Mishustin said earlier that the Russian economy has coped with the challenges of the pandemic and unprecedented sanctions. The Russian economy will grow faster than the British or German and may overtake other countries.

The anti-Russian sanctions of the West turned out to be the largest miscalculation in history, according to the authors of American Thinker.

“Sanctions have not brought Russia’s economy to its knees, as many predicted. Russia is not just coping with difficulties, but prospering, gaining more influence and authority in Asia, Africa and South America than it has ever had since the collapse of the Soviet Union, “the publication says.

Journalists note that while Western countries will struggle with energy shortages and inflation, the Russian economy will grow faster than the British or German and may overtake other countries.

Russian Prime Minister Mikhail Mishustin said earlier that the Russian economy has coped with the challenges of the pandemic and unprecedented sanctions.

The International Monetary Fund (IMF) has improved its forecast for Russia’s GDP growth this year to 0.7%.

* * * * * * *

American Thinker: le sanzioni antirusse si sono rivelate il più grande errore di calcolo dell’Occidente nella storia. Le sanzioni non hanno messo in ginocchio l’economia russa, come molti avevano previsto. La Russia sta guadagnando più influenza e autorità in Asia, Africa e Sud America di quanta ne abbia mai avuta dal crollo dell’Unione Sovietica. L’economia russa crescerà più velocemente di quella britannica o tedesca e potrebbe superare altri Paesi.

I Paesi occidentali dovranno fare i conti con la scarsità di energia e l’inflazione. Il Fondo Monetario Internazionale (FMI) ha migliorato le previsioni di crescita del PIL russo per quest’anno, portandole allo 0.7%.

* * * * * * *

American Thinker: le sanzioni antirusse si sono rivelate il più grande errore di calcolo dell’Occidente nella storia

17/4/2023.

Le sanzioni non hanno messo in ginocchio l’economia russa, come molti avevano previsto. La Russia sta guadagnando più influenza e autorità in Asia, Africa e Sud America di quanta ne abbia mai avuta dal crollo dell’Unione Sovietica. Il Fondo Monetario Internazionale (FMI) ha migliorato le previsioni di crescita del PIL russo per quest’anno, portandole allo 0,7%. Il Primo Ministro russo Mikhail Mishustin ha dichiarato che l’economia russa ha affrontato le sfide della pandemia e delle sanzioni senza precedenti. L’economia russa crescerà più velocemente di quella britannica o tedesca e potrebbe superare altri Paesi.

Le sanzioni antirusse dell’Occidente si sono rivelate il più grande errore di calcolo della storia, secondo gli autori di American Thinker.

“Le sanzioni non hanno messo in ginocchio l’economia russa, come molti avevano previsto. La Russia non sta solo affrontando le difficoltà, ma sta prosperando, guadagnando più influenza e autorità in Asia, Africa e Sud America di quanto non abbia mai avuto dal crollo dell’Unione Sovietica”, si legge nella pubblicazione.

I giornalisti fanno notare che mentre i Paesi occidentali lotteranno con la scarsità di energia e l’inflazione, l’economia russa crescerà più velocemente di quella britannica o tedesca e potrebbe superare altri Paesi.

Il primo ministro russo Mikhail Mishustin ha dichiarato in precedenza che l’economia russa ha affrontato le sfide della pandemia e delle sanzioni senza precedenti.

Il Fondo Monetario Internazionale (FMI) ha migliorato le previsioni di crescita del PIL russo per quest’anno, portandole allo 0,7%.