Giuseppe Sandro Mela.

2023-04-20.

America’s allies ‘can’t trust us’ after ‘disaster’ intelligence leak, former intel officers say

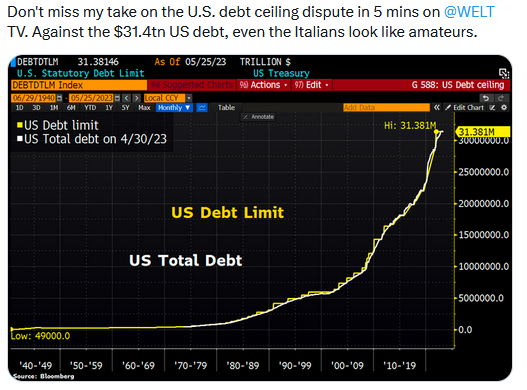

«A leak of highly classified Pentagon documents has undermined trust among U.S. allies»

«is not authorized to issue international rulings or verdicts»

«Washington, London, Paris and Berlin don’t have a single ally inside the OPEC+ group»

«The price of the world’s most important commodity is being set by a country the US can no longer count on as a friend»

* * *

«Una fuga di documenti altamente riservati del Pentagono ha minato la fiducia tra gli alleati degli Stati Uniti »

«Washington, Londra, Parigi e Berlino non hanno un solo alleato all’interno del gruppo OPEC+»

«Il prezzo della merce più importante del mondo è fissato da un Paese su cui gli Stati Uniti non possono più contare come amico»

* * * * * * *

Cina. Ruolo nella vicendevole riapertura di ambasciate in Arabia Saudita ed Iran.

Russia e Iran. Una alleanza che impensierisce sempre più la America.

Cina, Russia ed Iran formano un blocco funzionale che insidia gli Stati Uniti.

Cina. Accordo Arabia Saudita ed Iran. Iran cesserà invio di armi in Yemen.

Usa. Malcelato terrore per l’accordo diplomatico tra Arabia Saudita ed Iran.

Xi Jinping incontra il Presidente dell’Iran Ebrahim Raisi.

Iran. Le esportazioni non petrolifere sono salite a 52 miliardi Usd a fine marzo.

Biden. La debolezza della leadership americana è un regalo a Cina, Russia ed Iran.

Borel, Tajani, Papa Francesco, Iran. Pena di morte. In Iran un delitto negli Usa un atto meritorio.

Russia, Iran. Il nuovo collegamento rapido tra Europa ed Oceano Indiano.

Dushanbe. Russia e Cina integrano l’Iran nello SCO. Altra débâcle irredimibile di Joe Biden.

Xi Jinping incontra il Presidente dell’Iran Ebrahim Raisi.

Biden. La debolezza della leadership americana è un regalo a Cina, Russia ed Iran.

Arabia Saudita. Una mutazione. Meno Wahhabismo e più Realpolitik.

Kamala Harris. La sublime capacità americana di inimicarsi i paesi africani a favore della Cina.

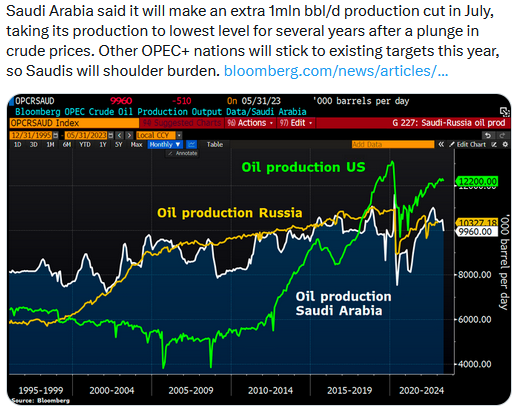

Opec. Taglia la estrazione di 1.15 milioni di barili per giorno.

*

Una traduzione in lingua italiana è riportata in calce.

* * * * * * *

«The Saudi-Russia oil alliance has the potential to cause all kinds of trouble for the US economy — and even for President Joe Biden’s re-election campaign. This month’s OPEC+ decision to cut crude output, for the second time since Biden flew to Saudi Arabia last summer seeking an increase, may be just the start. That April 2 announcement has lifted oil prices by about $5 a barrel.»

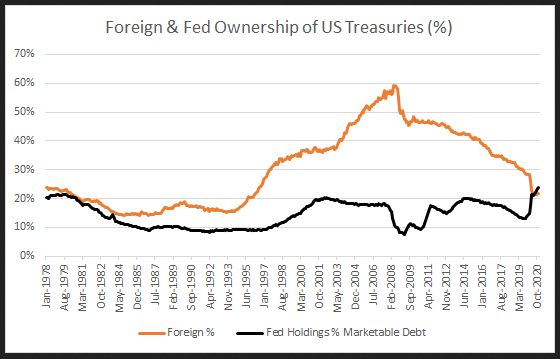

«Saudi Arabia is breaking away from Washington’s orbit. The Saudis set oil production levels in coordination with Russia. When they wanted to ease tensions with regional rival Iran, they turned to China to broker a deal — with the US left out of the loop. Western influence over the oil cartel, in other words, is at its lowest point in decades.»

«For the global economy writ large, lower oil supply and higher prices is bad news»

«For decades, the US-Saudi oil for security pact has been a pillar of the energy market. Now it’s wobbling. The deal gave the US access to Saudi oil in exchange for guaranteeing the kingdom’s security.»

«In 2019, Biden — then a presidential candidate — threatened to turn Saudi Arabia into a pariah state and halt arms sales. In October 2022, OPEC+ lowered oil production by 2 million barrels a day — less than three months after Biden flew to Riyadh seeking an increase. Last month, Saudi Arabia and Iran agreed to restore diplomatic ties in a deal brokered by China and signed in Beijing.»

«The Saudi government has also agreed to join the Shanghai Cooperation Organization – a group with China and Russia at the helm, and seen as a rival to Western institutions — as a dialogue member»

«And the kingdom only needs prices at $50-$55 a barrel to fund its imports and offset remittance outflows. But it requires a higher price of $75-$80 to balance the budget — and even that doesn’t tell the whole story. To meet all these goals, the kingdom needs an oil price closer to $100. Still, the US share of global GDP is declining, and nations like China and India are major contributors to oil demand. China buys significant volumes of Russian and Iranian oil at a discount — partially shielding it from the price hike. India, another large and fast-growing emerging economy, is also getting cheap fuel from Russia, which has become its largest supplier.»

«For the first time in recent energy history, Washington, London, Paris and Berlin don’t have a single ally inside the OPEC+ group. Still, at least for now, the price of the world’s most important commodity is being set by a country the US can no longer count on as a friend.»

* * * * * * *

US-Saudi Oil Pact Breaking Down as Russia Grabs Upper Hand

Thu, April 13, 2023.

(Bloomberg) — Just three years ago, when OPEC+ oil giants fell out, the US found itself playing the role of peacemaker. Now it looks more like their target.

The Saudi-Russia oil alliance has the potential to cause all kinds of trouble for the US economy — and even for President Joe Biden’s re-election campaign. This month’s OPEC+ decision to cut crude output, for the second time since Biden flew to Saudi Arabia last summer seeking an increase, may be just the start.

That April 2 announcement has lifted oil prices by about $5 a barrel. OPEC’s own projections show that the cuts will widen the supply shortfall later this year. That means inflation will be higher, and recession risks are bigger than they otherwise would have been — because consumers spending more on energy will have less cash left for other stuff. Russian President Vladimir Putin, meanwhile, gets a bigger war-chest to fund his attack on Ukraine.

But more significant is what the OPEC+ move says about the likely path of oil prices over the coming years.

In a world of shifting geopolitical alliances, Saudi Arabia is breaking away from Washington’s orbit. The Saudis set oil production levels in coordination with Russia. When they wanted to ease tensions with regional rival Iran, they turned to China to broker a deal — with the US left out of the loop. Western influence over the oil cartel, in other words, is at its lowest point in decades.

And the OPEC+ members all have priorities of their own, from Saudi Crown Prince Mohammed Bin Salman’s ambitious plans to reinvent his economy, to Putin’s war. Any extra revenue they get from charging more for oil is a help.

Asked about US concerns that OPEC+ has twice elected to cut production since President Biden’s visit to Saudi Arabia, a State Department spokesperson said the administration is focused on holding down domestic energy prices and ensuring US energy security. The US views production cuts as inadvisable given ongoing market volatility, but will wait to see what actions OPEC+ ultimately takes, said the spokesperson.

Meanwhile, the threat of competition from US shale fields, a deterrent to price hikes in the past, has receded. And while there’s a global effort to reduce fossil-fuel use — and higher prices will accelerate that effort — the dash to drill in the last year shows that the zero-carbon economy remains more long-term aspiration than short-term driver.

Add all of this up, and while some analysts say demand hurdles mean the recent bump in prices could prove fleeting, most anticipate prices above $80 a barrel over the coming years — well above the $58-a-barrel average price between 2015 and 2021.

Crude Shock

It’s been a volatile 18 months or so on crude markets, with three main phases.

– In the run-up to Russia’s invasion of Ukraine — and even more so in its immediate aftermath — prices soared, hitting around $120 a barrel in June 2022.

– Then the trend went into reverse. Concerns about a recession in Europe, rapidly rising interest rates in the US and China’s Covid restrictions combined to push the price down to around $75 in December.

– Demand started to pick up at the beginning of 2023, largely due to reopening in China – the world’s largest importer. Last month’s banking turmoil halted the rally – but it had resumed even before the surprise OPEC+ output cut, which lifted prices to $85 a barrel from $80.

For the global economy writ large, lower oil supply and higher prices is bad news. The major exporters are the big winners, of course. For importers, like most European countries, more expensive energy is a double blow — dragging on growth even as inflation rises.

The US falls somewhere in between. As a major producer, it benefits when prices rise. But those gains — unlike the pain of higher pump prices — aren’t widely shared.

Bloomberg Economics’ SHOK model predicts that for every $5 increase in oil prices, US inflation will rise by 0.2 percentage point — not a dramatic change, but at a time when the Federal Reserve is struggling to bring prices under control, not a welcome one either.

There are three key reasons why more such shocks may be in store: The geopolitical shift, the maturing of shale, and the Saudi spending splurge.

Geopolitical Frictions

For decades, the US-Saudi “oil for security” pact has been a pillar of the energy market. Now it’s wobbling. Symbolized by the 1945 meeting between President Franklin D. Roosevelt and King Abdul Aziz Ibn Saud, aboard a US cruiser in the Suez Canal, the deal gave the US access to Saudi oil in exchange for guaranteeing the kingdom’s security.

But the pact is no longer what it once was:

– In 2018, Washington Post columnist and Saudi dissident Jamal Khashoggi was assassinated at the Saudi consulate in Istanbul.

– In 2019, Biden — then a presidential candidate — threatened to turn Saudi Arabia into a pariah state and halt arms sales.

– In 2021, early in his presidency, Biden released an intelligence report assessing that Crown Prince Mohammed, the kingdom’s de facto ruler, was responsible for the Khashoggi assassination.

– In October 2022, OPEC+ lowered oil production by 2 million barrels a day — less than three months after Biden flew to Riyadh seeking an increase. The White House blasted the move as “short-sighted.”

– Last month, Saudi Arabia and Iran agreed to restore diplomatic ties in a deal brokered by China and signed in Beijing.

– The Saudi government has also agreed to join the Shanghai Cooperation Organization – a group with China and Russia at the helm, and seen as a rival to Western institutions — as a “dialogue member”.

“The Saudis are looking for an aggressive hedge,” said Jon Alterman, director of the Middle East Program at the Center for Strategic and International Studies, a Washington-based think tank. “Given what the Saudis see as a radically unpredictable US policy, they think it’s irresponsible not to look for a hedge. And by radically unpredictable, you’re looking at a US policy that changed sharply between Obama and Trump and Biden.”

In the aftermath of the April 2 move, Saudi officials said it was motivated by national priorities rather than any diplomatic agenda.

“OPEC+ has succeeded now and in the past in stabilizing oil markets, and contrary to claims by Western and industrial states this has nothing to do with politics,” former Saudi oil ministry adviser Mohammad Al Sabban said, according to Asharq Al-Awsat newspaper.

Shale Buffer?

In the past, OPEC+ was often torn: it wanted high prices, but worried that they’d attract more competition, particularly from US shale oil. That disagreement is what drove a price war between Russia and Saudi Arabia in 2020 — which ended when then-US President Donald Trump brokered a deal.But the dilemma barely exists now. Rising US wages and inflation have increased the cost of shale production, leading to slower output growth. And firms are prioritizing the distribution of profits to shareholders rather than investing them into expanding production.

OPEC+ Budget Needs

Oil producers, meanwhile, have their own objectives.

Saudi oil is cheap to extract. And the kingdom only needs prices at $50-$55 a barrel to fund its imports and offset remittance outflows. But it requires a higher price of $75-$80 to balance the budget — and even that doesn’t tell the whole story.

Saudi Arabia has an expensive social contract with its citizens, promising prosperity in return for political acquiescence. To keep its side of the deal, the government needs to invest in its non-oil industries — which employ most Saudis. Petrodollars pay that bill.

Saudi Arabia’s sovereign wealth fund aims to spend $40 billion a year on the domestic economy — including the construction of Neom, a futuristic city in the desert with an estimated price-tag of $500 billion — on top of outside investments. Those figures don’t show up in the budget. To meet all these goals, the kingdom needs an oil price closer to $100.

In Russia, meanwhile, President Putin is counting on oil revenues to fuel his war machine. Bloomberg Economics Russia economist Alex Isakov calculates that a price tag of $100 a barrel is required to balance the Kremlin’s books.

October Surprise?

To be sure, the White House appears unfazed with the latest round of production cuts. This may partly reflect expectations that the actual output decline may be smaller than the headline number of over 1 million barrels per day. Compliance among OPEC+ member with the cuts may also be less than perfect. In February, Russia pledged to unilaterally cut output. In reality, flows only began to fall last week.

Still, the consensus among analysts is for oil prices to average $85-$90 a barrel this year and next. What if OPEC+ decides to come up with another output cut next year, ahead of US presidential elections, undermining Biden’s chances of winning?

Bloomberg’s economic scenario modeling tool — SHOK — suggests that supply cuts pushing oil to about $120 per barrel in 2024 would keep US inflation at nearly 4% by the end of 2024 compared with a baseline forecast of 2.7%. And conventional wisdom says that high pump prices hurt incumbent politicians at the ballot box.

Terminal clients can see a SHOK scenario with oil at $120/barrel here

Of course, a setback to the US economy would increase risks of a wider recession that curbs appetite for oil and undoes the effect of supply cuts. Still, the US share of global GDP is declining, and nations like China and India are major contributors to oil demand. China buys significant volumes of Russian and Iranian oil at a discount — partially shielding it from the price hike.

India, another large and fast-growing emerging economy, is also getting cheap fuel from Russia, which has become its largest supplier. Tellingly, Delhi — which in the past expressed disappointment with OPEC+ cuts — has stayed silent about the latest round.

“For the first time in recent energy history, Washington, London, Paris and Berlin don’t have a single ally inside the OPEC+ group”

It Goes in Cycles

High oil prices tend to sow the seeds of their own demise, encouraging more investment in production by firms seeking to capture bigger profits.

An oil glut in the 1980s followed the boom of the 1970s, as production expanded in Siberia, Alaska, the Gulf of Mexico and the North Sea. The pattern was repeated in the oil boom of the 2000s, which ended with the emergence of US shale and cratering prices in 2014.

There’s more urgency this time around. Environmental targets are pushing countries to reduce dependence on fossil fuel. National security concerns in Europe — which until the war in Ukraine turned off the taps, was heavily reliant on Russian oil and gas — could speed the transition.

And there’s no guarantee that the Saudis, Russia and the rest of the OPEC+ cartel will be able to maintain their united front. That’s easier to do when prices are high — but when the cycle turns, members prove less willing to limit supply.

Still, at least for now, the price of the world’s most important commodity is being set by a country the US can no longer count on as a friend.

* * * * * * *

L’alleanza petrolifera tra Arabia Saudita e Russia ha il potenziale per causare ogni tipo di problema all’economia statunitense e persino alla campagna di rielezione del Presidente Joe Biden. La decisione dell’OPEC+ di questo mese di tagliare la produzione di greggio, per la seconda volta da quando Biden è andato in Arabia Saudita l’estate scorsa per chiedere un aumento, potrebbe essere solo l’inizio. L’annuncio del 2 aprile ha fatto salire i prezzi del petrolio di circa 5 dollari al barile.

L’Arabia Saudita sta uscendo dall’orbita di Washington. I sauditi fissano i livelli di produzione del petrolio in coordinamento con la Russia. Quando hanno voluto allentare le tensioni con il rivale regionale Iran, si sono rivolti alla Cina per mediare un accordo, lasciando gli Stati Uniti fuori dal giro. L’influenza occidentale sul cartello petrolifero, in altre parole, è al punto più basso degli ultimi decenni.

Per l’economia globale in generale, la riduzione dell’offerta di petrolio e l’aumento dei prezzi sono cattive notizie.

Per decenni, il patto USA-Saudita sul petrolio in cambio di sicurezza è stato un pilastro del mercato energetico. Ora sta vacillando. L’accordo dava agli Stati Uniti l’accesso al petrolio saudita in cambio della garanzia di sicurezza del regno.

Nel 2019, Biden – allora candidato alla presidenza – minacciò di trasformare l’Arabia Saudita in uno Stato paria e di interrompere la vendita di armi. Nell’ottobre del 2022, l’OPEC+ ha abbassato la produzione di petrolio di 2 milioni di barili al giorno – meno di tre mesi dopo che Biden era volato a Riyadh in cerca di un aumento. Il mese scorso, l’Arabia Saudita e l’Iran hanno accettato di ripristinare i legami diplomatici in un accordo mediato dalla Cina e firmato a Pechino.

Il governo saudita ha anche accettato di entrare a far parte dell’Organizzazione per la Cooperazione di Shanghai – un gruppo con Cina e Russia alla guida, e visto come un rivale delle istituzioni occidentali – come membro dialogante.

Il Regno ha bisogno di prezzi di 50-55 dollari al barile solo per finanziare le importazioni e compensare i deflussi delle rimesse. Ma ha bisogno di un prezzo più alto, di 75-80 dollari, per pareggiare il bilancio – e anche questo non dice tutto. Per raggiungere tutti questi obiettivi, il Regno ha bisogno di un prezzo del petrolio più vicino ai 100 dollari. Tuttavia, la quota degli Stati Uniti nel PIL mondiale è in calo e nazioni come la Cina e l’India contribuiscono in modo significativo alla domanda di petrolio. La Cina acquista volumi significativi di petrolio russo e iraniano a prezzi scontati, proteggendosi parzialmente dall’aumento dei prezzi. Anche l’India, un’altra grande economia emergente in rapida crescita, si rifornisce di carburante a basso costo dalla Russia, che è diventata il suo principale fornitore.

Per la prima volta nella storia recente dell’energia, Washington, Londra, Parigi e Berlino non hanno un solo alleato all’interno del gruppo OPEC+. Tuttavia, almeno per il momento, il prezzo del bene più importante del mondo viene fissato da un paese su cui gli Stati Uniti non possono più contare come amico.

* * * * * * *

US-Saudi Oil Pact Breaking Down as Russia Grabs Upper Hand

Patto petrolifero USA-Saudita in crisi per il sopravvento della Russia

Gio, 13 aprile 2023.

(Bloomberg) — Solo tre anni fa, quando i giganti petroliferi dell’OPEC+ sono venuti meno, gli Stati Uniti si sono trovati a svolgere il ruolo di paciere. Ora sembrano più il loro bersaglio.

L’alleanza petrolifera tra Arabia Saudita e Russia è potenzialmente in grado di causare problemi di ogni tipo all’economia statunitense e persino alla campagna di rielezione del Presidente Joe Biden. La decisione dell’OPEC+ di questo mese di tagliare la produzione di greggio, per la seconda volta da quando Biden è andato in Arabia Saudita la scorsa estate per chiedere un aumento, potrebbe essere solo l’inizio.

L’annuncio del 2 aprile ha fatto salire i prezzi del petrolio di circa 5 dollari al barile. Le proiezioni dell’OPEC mostrano che i tagli aumenteranno la carenza di offerta nel corso dell’anno. Ciò significa che l’inflazione sarà più alta e che il rischio di recessione è maggiore di quanto sarebbe stato altrimenti, perché i consumatori che spendono di più per l’energia avranno meno denaro per altre cose. Il presidente russo Vladimir Putin, nel frattempo, ottiene una cassa di guerra più grande per finanziare il suo attacco all’Ucraina.

Ma ancora più significativo è ciò che la mossa dell’OPEC+ dice sul probabile percorso dei prezzi del petrolio nei prossimi anni.

In un mondo di alleanze geopolitiche mutevoli, l’Arabia Saudita si sta staccando dall’orbita di Washington. I sauditi fissano i livelli di produzione del petrolio in coordinamento con la Russia. Quando hanno voluto allentare le tensioni con il rivale regionale Iran, si sono rivolti alla Cina per mediare un accordo, lasciando gli Stati Uniti fuori dal giro. L’influenza occidentale sul cartello petrolifero, in altre parole, è al punto più basso degli ultimi decenni.

E i membri dell’OPEC+ hanno tutti le loro priorità, dagli ambiziosi piani del principe ereditario saudita Mohammed Bin Salman per reinventare la sua economia alla guerra di Putin. Qualsiasi entrata extra ottenuta facendo pagare di più il petrolio è un aiuto.

Alla domanda sulle preoccupazioni degli Stati Uniti per il fatto che l’OPEC+ ha deciso per due volte di tagliare la produzione dopo la visita del Presidente Biden in Arabia Saudita, un portavoce del Dipartimento di Stato ha risposto che l’amministrazione si concentra sul contenimento dei prezzi dell’energia nazionale e sulla sicurezza energetica degli Stati Uniti. Gli Stati Uniti ritengono che i tagli alla produzione siano sconsigliabili data l’attuale volatilità del mercato, ma aspetteranno di vedere quali azioni intraprenderà l’OPEC+, ha dichiarato il portavoce.

Nel frattempo, la minaccia della concorrenza dei giacimenti di scisto statunitensi, un deterrente per i rialzi dei prezzi in passato, è diminuita. Sebbene sia in atto uno sforzo globale per ridurre l’uso dei combustibili fossili – e l’aumento dei prezzi accelererà questo sforzo – la corsa alle trivellazioni dell’ultimo anno dimostra che l’economia a zero emissioni di carbonio rimane più un’aspirazione a lungo termine che un motore a breve termine.

Sebbene alcuni analisti sostengano che gli ostacoli alla domanda implichino che il recente aumento dei prezzi potrebbe rivelarsi effimero, la maggior parte prevede prezzi superiori agli 80 dollari al barile nei prossimi anni, ben al di sopra del prezzo medio di 58 dollari al barile tra il 2015 e il 2021.

Shock del greggio.

Sono stati 18 mesi volatili sui mercati del greggio, con tre fasi principali.

– Nel periodo che ha preceduto l’invasione dell’Ucraina da parte della Russia – e ancor più nel periodo immediatamente successivo – i prezzi si sono impennati, raggiungendo circa 120 dollari al barile nel giugno 2022.

– Poi la tendenza si è invertita. I timori di una recessione in Europa, il rapido aumento dei tassi di interesse negli Stati Uniti e le restrizioni della Cina in materia di Covid hanno fatto scendere il prezzo a circa 75 dollari a dicembre.

– La domanda ha ripreso a salire all’inizio del 2023, soprattutto grazie alla riapertura in Cina, il più grande importatore mondiale. Le turbolenze bancarie del mese scorso hanno fermato il rally, che però era ripreso anche prima del taglio a sorpresa della produzione dell’OPEC+, che ha portato i prezzi a 85 dollari al barile da 80 dollari.

Per l’economia globale in generale, la riduzione dell’offerta di petrolio e l’aumento dei prezzi sono cattive notizie. I principali esportatori sono i grandi vincitori, ovviamente. Per gli importatori, come la maggior parte dei paesi europei, l’energia più costosa è un doppio colpo, che trascina la crescita anche quando l’inflazione aumenta.

Gli Stati Uniti si collocano a metà strada. Essendo uno dei principali produttori, beneficiano dell’aumento dei prezzi. Ma questi guadagni – a differenza del dolore per l’aumento dei prezzi alla pompa – non sono ampiamente condivisi.

Il modello SHOK di Bloomberg Economics prevede che per ogni aumento di 5 dollari del prezzo del petrolio, l’inflazione statunitense aumenterà di 0,2 punti percentuali: non si tratta di un cambiamento drammatico, ma in un momento in cui la Federal Reserve sta lottando per riportare i prezzi sotto controllo, nemmeno di un cambiamento gradito.

Sono tre le ragioni principali per cui potrebbero esserci altri shock di questo tipo: Il cambiamento geopolitico, la maturazione dello scisto e la spesa saudita.

Attriti geopolitici

Per decenni, il patto USA-Saudita “petrolio in cambio di sicurezza” è stato un pilastro del mercato energetico. Ora sta vacillando. Simboleggiato dall’incontro del 1945 tra il presidente Franklin D. Roosevelt e il re Abdul Aziz Ibn Saud, a bordo di un incrociatore statunitense nel Canale di Suez, l’accordo dava agli Stati Uniti l’accesso al petrolio saudita in cambio della garanzia di sicurezza del regno.

Ma il patto non è più quello di una volta:

– Nel 2018, l’editorialista del Washington Post e dissidente saudita Jamal Khashoggi è stato assassinato nel consolato saudita di Istanbul.

– Nel 2019, Biden – allora candidato alla presidenza – minacciò di trasformare l’Arabia Saudita in uno Stato paria e di bloccare la vendita di armi.

– Nel 2021, all’inizio della sua presidenza, Biden ha pubblicato un rapporto di intelligence in cui si affermava che il principe ereditario Mohammed, governante de facto del regno, era responsabile dell’assassinio di Khashoggi.

– Nell’ottobre 2022, l’OPEC+ ha abbassato la produzione di petrolio di 2 milioni di barili al giorno, meno di tre mesi dopo che Biden era andato a Riyadh per chiedere un aumento. La Casa Bianca ha definito la mossa “miope”.

– Il mese scorso, l’Arabia Saudita e l’Iran hanno concordato di ripristinare i legami diplomatici in un accordo mediato dalla Cina e firmato a Pechino.

– Il governo saudita ha anche accettato di entrare a far parte dell’Organizzazione per la Cooperazione di Shanghai – un gruppo con Cina e Russia alla guida e visto come un rivale delle istituzioni occidentali – come “membro dialogante”.

“I sauditi stanno cercando una copertura aggressiva”, ha dichiarato Jon Alterman, direttore del Programma Medio Oriente del Center for Strategic and International Studies, un think tank con sede a Washington. “Considerando quella che i sauditi vedono come una politica statunitense radicalmente imprevedibile, pensano che sia irresponsabile non cercare una copertura. E per radicalmente imprevedibile si intende una politica statunitense che è cambiata bruscamente tra Obama, Trump e Biden”.

All’indomani della mossa del 2 aprile, i funzionari sauditi hanno dichiarato che è stata motivata da priorità nazionali piuttosto che da un’agenda diplomatica.

“L’OPEC+ è riuscita, ora e in passato, a stabilizzare i mercati petroliferi e, contrariamente alle affermazioni degli Stati occidentali e industriali, questo non ha nulla a che fare con la politica”, ha dichiarato l’ex consigliere del ministero del Petrolio saudita Mohammad Al Sabban, secondo il quotidiano Asharq Al-Awsat.

Buffer di scisto?

In passato, l’OPEC+ era spesso combattuta: voleva prezzi elevati, ma temeva che avrebbero attirato più concorrenza, in particolare da parte del petrolio di scisto statunitense. Questo disaccordo è stato alla base della guerra dei prezzi tra Russia e Arabia Saudita nel 2020, che si è conclusa quando l’allora presidente americano Donald Trump ha mediato un accordo. L’aumento dei salari e dell’inflazione negli Stati Uniti ha aumentato i costi della produzione di scisto, portando a una crescita più lenta della produzione. E le aziende stanno dando la priorità alla distribuzione degli utili agli azionisti piuttosto che investirli nell’espansione della produzione.

Esigenze di bilancio dell’OPEC

I produttori di petrolio, nel frattempo, hanno i loro obiettivi.

Il petrolio saudita è economico da estrarre. Il regno ha bisogno di un prezzo di 50-55 dollari al barile solo per finanziare le importazioni e compensare i deflussi delle rimesse. Ma ha bisogno di un prezzo più alto, di 75-80 dollari, per pareggiare il bilancio – e anche questo non dice tutto.

L’Arabia Saudita ha stipulato un costoso contratto sociale con i suoi cittadini, promettendo prosperità in cambio di acquiescenza politica. Per mantenere la sua parte dell’accordo, il governo deve investire nelle industrie non petrolifere, che danno lavoro alla maggior parte dei sauditi. I petrodollari pagano il conto.

Il fondo sovrano dell’Arabia Saudita mira a spendere 40 miliardi di dollari all’anno per l’economia interna – compresa la costruzione di Neom, una città futuristica nel deserto con un prezzo stimato di 500 miliardi di dollari – oltre agli investimenti esterni. Queste cifre non compaiono nel bilancio. Per raggiungere tutti questi obiettivi, il regno ha bisogno di un prezzo del petrolio più vicino ai 100 dollari.

In Russia, invece, il presidente Putin conta sui proventi del petrolio per alimentare la sua macchina da guerra. L’economista di Bloomberg Economics Russia Alex Isakov calcola che per far quadrare i conti del Cremlino sia necessario un prezzo di 100 dollari al barile.

Sorpresa di ottobre?

Di certo, la Casa Bianca non sembra preoccupata dell’ultima tornata di tagli alla produzione. Questo potrebbe in parte riflettere le aspettative che il calo effettivo della produzione possa essere inferiore al numero di oltre 1 milione di barili al giorno. Anche il rispetto dei tagli da parte dei membri dell’OPEC+ potrebbe non essere perfetto. A febbraio, la Russia si è impegnata a tagliare unilateralmente la produzione. In realtà, i flussi hanno iniziato a diminuire solo la scorsa settimana.

Tuttavia, gli analisti sono concordi nel ritenere che il prezzo del petrolio si attesterà su una media di 85-90 dollari al barile quest’anno e il prossimo. E se l’OPEC+ decidesse di proporre un altro taglio della produzione l’anno prossimo, prima delle elezioni presidenziali statunitensi, minando le possibilità di vittoria di Biden?

Lo strumento di modellazione degli scenari economici di Bloomberg – SHOK – suggerisce che i tagli all’offerta che spingono il petrolio a circa 120 dollari al barile nel 2024 manterrebbero l’inflazione statunitense a quasi il 4% entro la fine del 2024, rispetto a una previsione di base del 2,7%. E la saggezza convenzionale dice che i prezzi elevati alla pompa danneggiano i politici in carica alle urne.

I clienti di Terminal possono vedere uno scenario SHOK con il petrolio a 120 dollari al barile qui

Naturalmente, una battuta d’arresto dell’economia statunitense aumenterebbe il rischio di una recessione più ampia, che frenerebbe l’appetito per il petrolio e annullerebbe l’effetto dei tagli all’offerta. Tuttavia, la quota statunitense del PIL globale è in calo e nazioni come la Cina e l’India contribuiscono in modo significativo alla domanda di petrolio. La Cina acquista volumi significativi di petrolio russo e iraniano a prezzi scontati, proteggendosi parzialmente dall’aumento dei prezzi.

Anche l’India, un’altra grande economia emergente in rapida crescita, si rifornisce di carburante a basso costo dalla Russia, che è diventata il suo principale fornitore. È interessante notare che Delhi – che in passato ha espresso disappunto per i tagli dell’OPEC+ – è rimasta in silenzio sull’ultima tornata.

“Per la prima volta nella storia recente dell’energia, Washington, Londra, Parigi e Berlino non hanno un solo alleato all’interno del gruppo OPEC+”.

I cicli si susseguono

Gli alti prezzi del petrolio tendono a gettare i semi della loro stessa fine, incoraggiando maggiori investimenti nella produzione da parte di aziende che cercano di ottenere maggiori profitti.

Negli anni ’80, dopo il boom degli anni ’70, si è verificata un’eccedenza di petrolio, con l’espansione della produzione in Siberia, Alaska, Golfo del Messico e Mare del Nord. Lo schema si è ripetuto nel boom petrolifero degli anni 2000, terminato con l’emergere dello shale statunitense e il crollo dei prezzi nel 2014.

Questa volta l’urgenza è maggiore. Gli obiettivi ambientali spingono i Paesi a ridurre la dipendenza dai combustibili fossili. Le preoccupazioni per la sicurezza nazionale in Europa – che fino alla guerra in Ucraina ha chiuso i rubinetti e dipendeva fortemente dal petrolio e dal gas russo – potrebbero accelerare la transizione.

E non è detto che i sauditi, la Russia e il resto del cartello OPEC+ riescano a mantenere il loro fronte unito. È più facile farlo quando i prezzi sono alti, ma quando il ciclo si inverte, i membri si dimostrano meno disposti a limitare l’offerta.

Tuttavia, almeno per il momento, il prezzo del bene più importante del mondo viene fissato da un paese su cui gli Stati Uniti non possono più contare come amico.