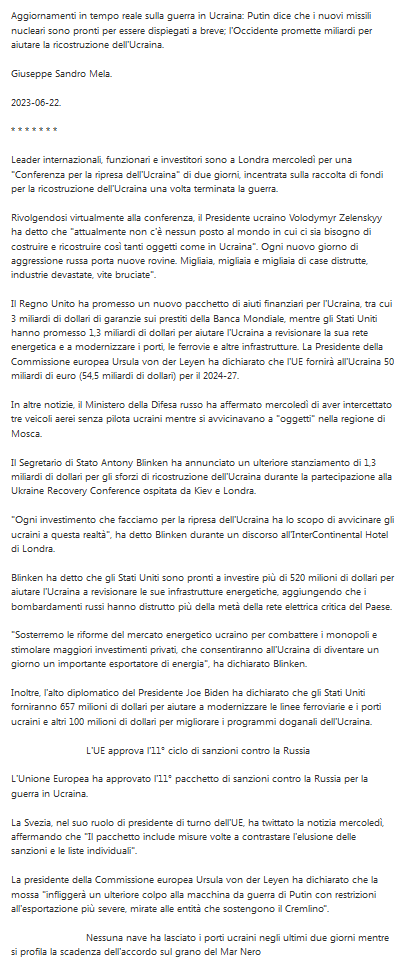

Giuseppe Sandro Mela.

2023-05-11.

«China is putting the yuan front and centre in its fight back against the United States’ unique influence over global money. President Xi Jinping’s government has been busy striking deals over the past year to expand the ways in which the currency is used, with new agreements linked to the yuan stretching from Russia and Saudi Arabia to Brazil and even France. While the United States remains the world’s clear financial hegemon, the moves are helping China to carve out a bigger place for itself in the international financial system.»

«Hard-hitting sanctions on Russia have revealed a new willingness by the United States to weaponise the dollar. That’s spurred leaders in Beijing to up the ante in building the country – and in particular its currency – into an alternative pole for international finance, trade and lending.»

«There’s a world outside of the United States and the Western world. You’re sending a very strong signal to the United States by basically saying we don’t need you and we don’t need your dollar. Unease with the dominance of the United States and the greenback is pushing some countries and companies to diversify away from America and Europe. That’s still a tiny portion of global transactions, and the currency remains tightly controlled by Chinese authorities.»

«His first foreign excursions after lifting lockdowns were to key energy suppliers Saudi Arabia and Russia. Trips to Beijing by Brazilian President Luiz Inacio Lula da Silva and France’s Emmanuel Macron were accompanied by a host of new commercial agreements. And China was central to brokering an Iran-Saudi detente.»

«China has developed its own international-payments platform – CIPS – that’s entirely separate from Swift, which has been embraced not only by institutions in Russia, but also by banks that operate in places like Brazil.»

* * *

«La Cina sta mettendo lo yuan in primo piano nella sua lotta contro l’influenza unica degli Stati Uniti sulla moneta globale. Nell’ultimo anno il governo del presidente Xi Jinping si è impegnato a stringere accordi per ampliare le modalità di utilizzo della valuta, con nuovi accordi legati allo yuan che si estendono dalla Russia e dall’Arabia Saudita al Brasile e persino alla Francia. Mentre gli Stati Uniti rimangono il chiaro egemone finanziario del mondo, le mosse stanno aiutando la Cina a ritagliarsi uno spazio maggiore nel sistema finanziario internazionale»

«Le dure sanzioni alla Russia hanno rivelato una nuova volontà degli Stati Uniti di usare il dollaro come una arma. Questo ha spinto i leader di Pechino ad alzare la posta in gioco per trasformare il Paese – e in particolare la sua valuta – in un polo alternativo per la finanza, il commercio e i prestiti internazionali»

«C’è un mondo al di fuori degli Stati Uniti e del mondo occidentale. Stanno inviando un segnale molto forte agli Stati Uniti, dicendo sostanzialmente che non hanno bisogno di loro e non hanno bisogno del loro dollaro”. L’insoddisfazione per il dominio degli Stati Uniti e del biglietto verde sta spingendo alcuni Paesi e aziende a diversificarsi dall’America e dall’Europa. Si tratta ancora di una piccola parte delle transazioni globali e la valuta rimane strettamente controllata dalle autorità cinesi»

«Le sue prime escursioni all’estero dopo la revoca delle restrizioni sono state in Arabia Saudita e Russia, fornitori chiave di energia. I viaggi a Pechino del presidente brasiliano Luiz Inacio Lula da Silva e del francese Emmanuel Macron sono stati accompagnati da una serie di nuovi accordi commerciali. E la Cina ha avuto un ruolo centrale nel mediare una distensione tra Iran e Arabia Saudita»

«La Cina ha sviluppato una propria piattaforma per i pagamenti internazionali, CIPS, completamente separata da Swift, che è stata adottata non solo da istituzioni russe, ma anche da banche che operano in luoghi come il Brasile»

* * * * * * *

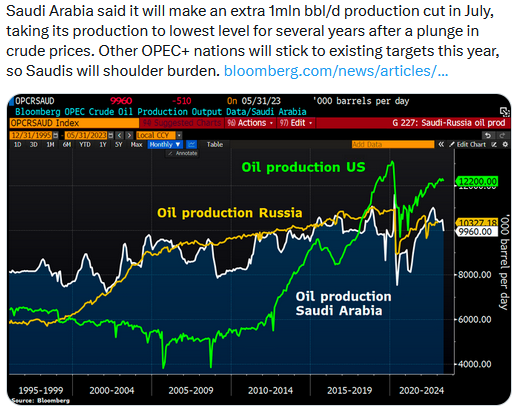

Arabia Saudita. Russia e Cina rimpiazzano gli Stati Uniti nel patto petrolifero.

Cina. Sta imponendo il suo Nuovo Ordine Mondiale.

Cina e Brasile commerceranno in Yuan. Il dollaro è escluso.

Usa. Le sanzioni di Joe Biden hanno generato un possente mercato dello Yuan.

Cina, Russia e Blocco Euroasiatico. Con il 40% del pil mondiale vogliono scalzare il dollaro.

* * * * * * *

China Takes the Yuan Global in Bid to Repel a Weaponized Dollar

Friday, 05 May 2023.

Beijing: China is putting the yuan front and centre in its fight back against the United States’ unique influence over global money.

President Xi Jinping’s government has been busy striking deals over the past year to expand the ways in which the currency is used, with new agreements linked to the yuan stretching from Russia and Saudi Arabia to Brazil and even France.

While the United States remains the world’s clear financial hegemon, the moves are helping China to carve out a bigger place for itself in the international financial system.

They come at a time when geopolitical strains are growing and global commerce is becoming an ever-more-active battleground.

Antagonism has flared between the two economic titans over issues ranging from trade and Taiwan to TikTok and technological know-how.

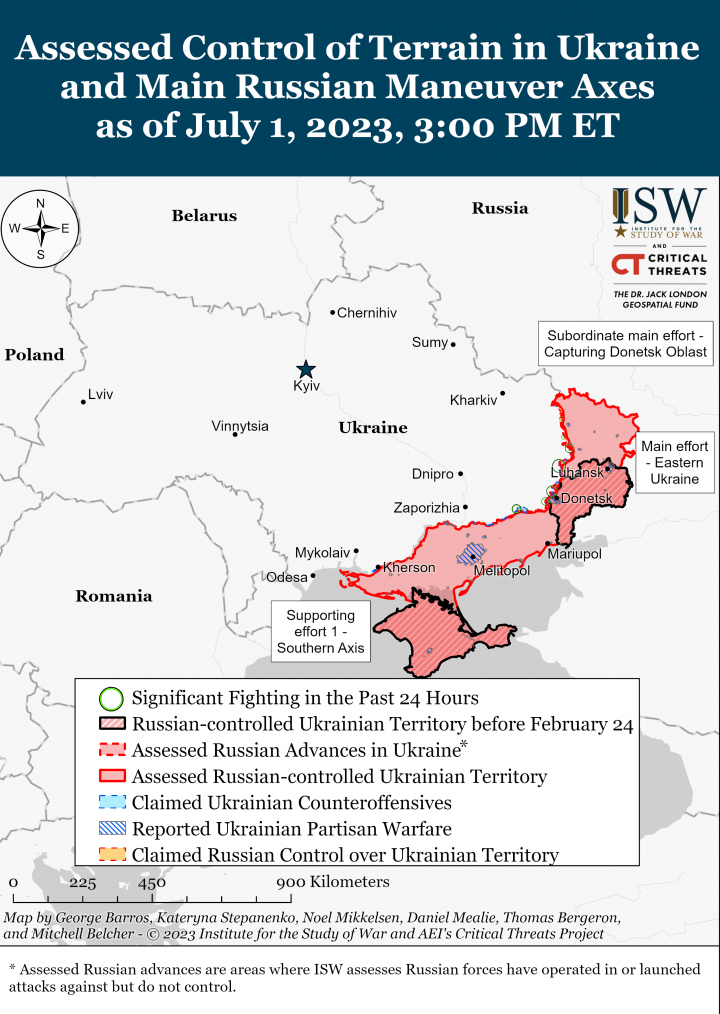

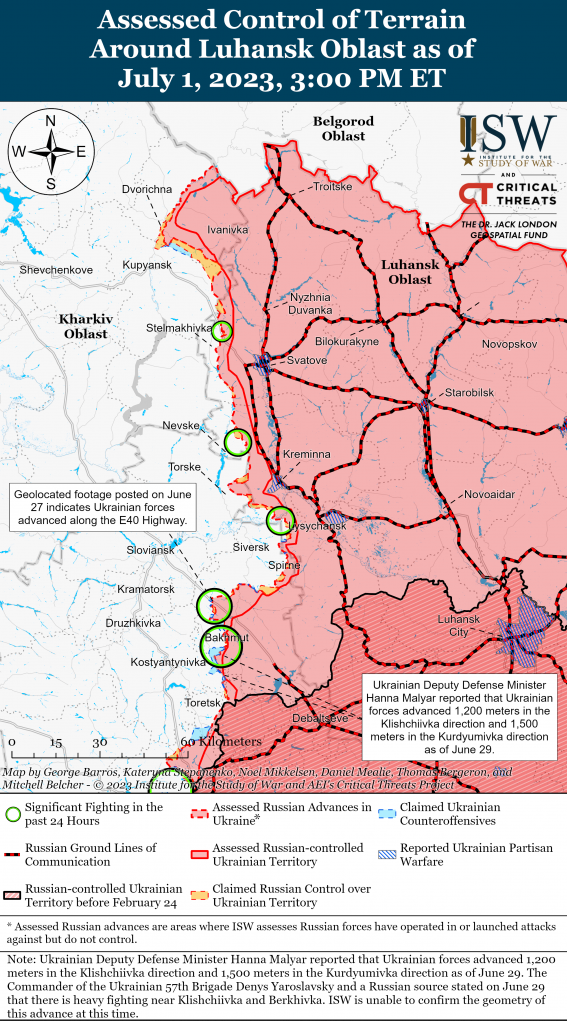

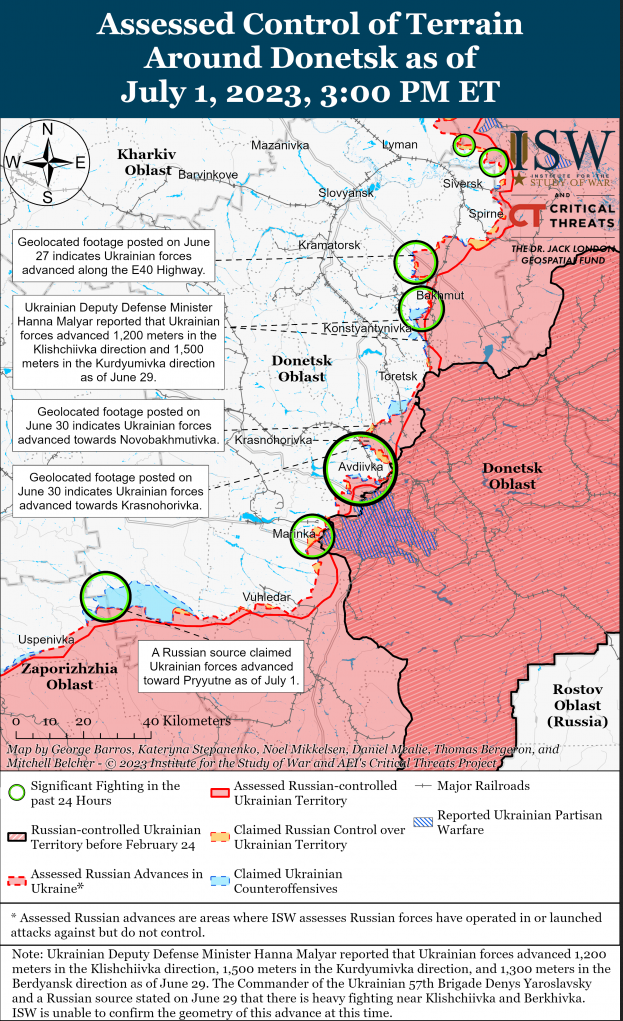

Hard-hitting sanctions on Russia have revealed a new willingness by the United States to weaponise the dollar.

Together, that’s done more to promote China’s yuan over the past year than Xi’s government achieved in the preceding decade.

The ramp-up is also a response to China’s shifting position within the global economy as it emerges from the era of Covid-lockdowns with growth running more slowly than it once did and the global push for freer trade in retreat.

That’s spurred leaders in Beijing to up the ante in building the country – and in particular its currency – into an alternative pole for international finance, trade and lending.

The nation is working to demonstrate “that there’s a world outside of the United States and the Western world,” said Adrian Zuercher, head of global asset allocation and co-head of global investment management for the Asia-Pacific region at UBS global wealth management’s office in Hong Kong.

“You’re sending a very strong signal to the United States by basically saying we don’t need you and we don’t need your dollar.”

That message is resonating in some parts of the world.

Unease with the dominance of the United States and the greenback is pushing some countries and companies to diversify away from America and Europe.

The use of the yuan in contracts for everything from oil to nickel is gathering speed, with the currency’s share of global trade finance tripling since the end of 2019.

That’s still a tiny portion of global transactions, and the currency remains tightly controlled by Chinese authorities.

But sanctions that ensnared Moscow following its invasion of Ukraine have added to that pace.

The yuan’s usage in Russian export payments surged 32-fold last year alone.

Xi, who is embarking on his second decade in charge of the People’s Republic, has taken steps to promote the country’s reputation abroad, even as he focuses on implementing reforms and bolstering growth at home.

His first foreign excursions after lifting lockdowns were to key energy suppliers Saudi Arabia and Russia.

Trips to Beijing by Brazilian President Luiz Inacio Lula da Silva and France’s Emmanuel Macron were accompanied by a host of new commercial agreements.

And China was central to brokering an Iran-Saudi detente.

With the United States, though, flashpoints have multiplied – from feuds over spy balloons to semiconductor technology.

The ostracism of Russia in the wake of Vladimir Putin’s war in Ukraine has provided China with an important opening to demonstrate just how the yuan can be used.

It also stoked concern among some nations about being beholden to the dollar and the euro, the two biggest currencies.

Locked out of the central international payments system known as Swift, Russia embraced the yuan for trade, private savings and foreign-exchange transactions. China has developed its own international-payments platform – CIPS – that’s entirely separate from Swift, which has been embraced not only by institutions in Russia, but also by banks that operate in places like Brazil.

“China’s willingness to maintain growth while paving new paths lends itself for other nations to have greater confidence to use the yuan,’’ said Victor Gao, a professor at Soochow University and vice-president of the think tank Centre for China and Globalisation.

“If the United States wants to rock the boat, then China will need to make necessary amendments to meet the challenges.’’ — Bloomberg.

* * * * * * *

China Takes the Yuan Global in Bid to Repel a Weaponized Dollar

La Cina rende globale lo Yuan nel tentativo di respingere un dollaro armato

Venerdì 05 maggio 2023.

Pechino: La Cina sta mettendo lo yuan in primo piano nella sua lotta contro l’influenza unica degli Stati Uniti sulla moneta globale.

Nell’ultimo anno il governo del presidente Xi Jinping si è impegnato a stringere accordi per ampliare le modalità di utilizzo della valuta, con nuovi accordi legati allo yuan che si estendono dalla Russia e dall’Arabia Saudita al Brasile e persino alla Francia.

Sebbene gli Stati Uniti rimangano il chiaro egemone finanziario del mondo, le mosse stanno aiutando la Cina a ritagliarsi uno spazio maggiore nel sistema finanziario internazionale.

Esse giungono in un momento in cui le tensioni geopolitiche aumentano e il commercio globale diventa un campo di battaglia sempre più attivo.

L’antagonismo tra i due titani economici è esploso su questioni che vanno dal commercio e Taiwan a TikTok e al know-how tecnologico.

Le dure sanzioni alla Russia hanno rivelato una nuova volontà degli Stati Uniti di armare il dollaro.

Insieme, nell’ultimo anno hanno fatto più cose per promuovere lo yuan cinese di quante ne abbia fatte il governo di Xi nel decennio precedente.

L’aumento è anche una risposta al cambiamento della posizione della Cina nell’economia globale, che sta uscendo dall’era dei blocchi di Covid, con una crescita più lenta di un tempo e la spinta globale per un commercio più libero in ritirata.

Ciò ha spinto i leader di Pechino ad alzare la posta in gioco per trasformare il Paese – e in particolare la sua valuta – in un polo alternativo per la finanza, il commercio e i prestiti internazionali.

La nazione sta lavorando per dimostrare “che c’è un mondo al di fuori degli Stati Uniti e del mondo occidentale”, ha dichiarato Adrian Zuercher, responsabile dell’asset allocation globale e co-responsabile della gestione degli investimenti globali per la regione Asia-Pacifico presso l’ufficio di UBS global wealth management a Hong Kong.

“State inviando un segnale molto forte agli Stati Uniti, dicendo sostanzialmente che non abbiamo bisogno di voi e non abbiamo bisogno del vostro dollaro”.

Questo messaggio sta risuonando in alcune parti del mondo.

L’insoddisfazione per il dominio degli Stati Uniti e del biglietto verde sta spingendo alcuni Paesi e aziende a diversificarsi dall’America e dall’Europa.

L’uso dello yuan nei contratti per qualsiasi cosa, dal petrolio al nickel, sta prendendo piede: la quota della valuta nei finanziamenti del commercio globale è triplicata dalla fine del 2019.

Si tratta ancora di una piccola parte delle transazioni globali e la valuta rimane strettamente controllata dalle autorità cinesi.

Ma le sanzioni imposte a Mosca dopo l’invasione dell’Ucraina hanno accelerato il ritmo.

L’utilizzo dello yuan nei pagamenti delle esportazioni russe è aumentato di 32 volte solo lo scorso anno.

Xi, che sta per iniziare il suo secondo decennio alla guida della Repubblica Popolare, ha preso provvedimenti per promuovere la reputazione del Paese all’estero, anche se si concentra sull’attuazione delle riforme e sul rafforzamento della crescita interna.

Le sue prime escursioni all’estero dopo la revoca dei blocchi sono state in Arabia Saudita e Russia, fornitori chiave di energia.

I viaggi a Pechino del presidente brasiliano Luiz Inacio Lula da Silva e del francese Emmanuel Macron sono stati accompagnati da una serie di nuovi accordi commerciali.

E la Cina ha avuto un ruolo centrale nel mediare una distensione tra Iran e Arabia Saudita.

Con gli Stati Uniti, invece, i punti di contatto si sono moltiplicati, dalle faide sui palloni spia alla tecnologia dei semiconduttori.

L’ostracismo della Russia in seguito alla guerra di Vladimir Putin in Ucraina ha fornito alla Cina un’importante apertura per dimostrare come può essere usato lo yuan.

Ha anche alimentato la preoccupazione di alcune nazioni di essere vincolate al dollaro e all’euro, le due valute più importanti.

Bloccata dal sistema centrale di pagamenti internazionali noto come Swift, la Russia ha abbracciato lo yuan per il commercio, i risparmi privati e le transazioni in valuta estera. La Cina ha sviluppato una propria piattaforma di pagamenti internazionali – CIPS – completamente separata da Swift, che è stata abbracciata non solo dalle istituzioni russe, ma anche da banche che operano in luoghi come il Brasile.

La volontà della Cina di mantenere la crescita e al tempo stesso di aprire nuove strade, consente agli altri Paesi di avere maggiore fiducia nell’uso dello yuan”, ha dichiarato Victor Gao, professore dell’Università di Soochow e vicepresidente del think tank Centre for China and Globalisation.

“Se gli Stati Uniti vogliono far vacillare la barca, la Cina dovrà apportare le modifiche necessarie per affrontare le sfide”. – Bloomberg.