Giuseppe Sandro Mela.

2018-05-24.

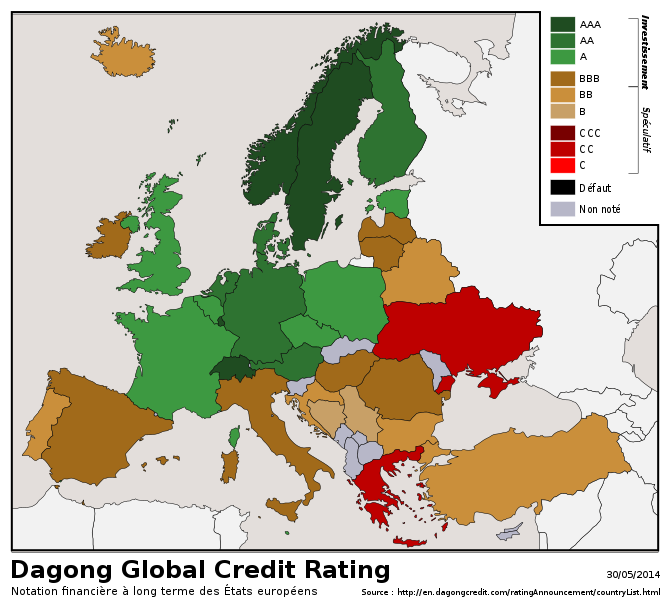

«Dagong Global Credit Rating (Chinese: 大公国际资信评估有限公司; pinyin: Dàgōng Guójì Zīxìn Pínggū Yǒuxiàn Gōngsī) is a credit rating agency based in China.

The company was established in 1994, following approval by the People’s Bank of China and the State Economic and Trade Division of the People’s Republic of China.

In May 2009, an agreement of mutual cooperation was signed with Xinhua news agency, reported as “promoting a national credit rating system”.

In June 2013, Dagong Europe Credit Rating was registered and received authorisation from the European Securities and Markets Authority as Credit Rating Agency. In the same year, it was recognised by the Joint Committee of the three European Supervisory Authorities (EBA, ESMA and EIOPA) as External Credit Assessment Institution operating in the European Union.

In July 2014, Dagong Global Credit Rating (Hong Kong) Co., Limited was granted a Type 10 License (Providing Credit Rating Services) by the Securities and Futures Commission of Hong Kong.»

*

«AAA: Highest credit rating

AA: Very High credit rating

A: High credit rating

BBB: Medium credit rating

BB: Low medium credit rating

B: Relatively low credit rating

CCC: Low credit rating

CC: Very low credit rating.

C: Lowest credit rating. Issuer is unable to meet financial obligations and possibly in the process of bankruptcy.» [Fonte]

*

E così Dagong ha ulteriormente declassato i titoli di stato italiani.

«L’agenzia cinese di rating Dagong, la più severa sul debito occidentale, ha classificato qualche giorno fa i titoli di Stato italiani come BB+, un livello che si trova al di sotto dell’investment grade e viene classificato come speculative grade, cioè spazzatura»