Giuseppe Sandro Mela.

2020-11-05.

«The sustainable debt market has become unsustainable»

«The European Union has offered its first social bond—as in the middle initial of ESG: environmental, social, and governance—in a two-part, 17 billion euro ($20.2 billion) sale»

«Investors were ravenous. When all was said and done, the offering was oversubscribed 14 times over. Orders blew past 233 billion euros, making it likely the biggest debt sale ever»

«It’s easily double the previous record demand of 108 billion euros for Italian debt in June.»

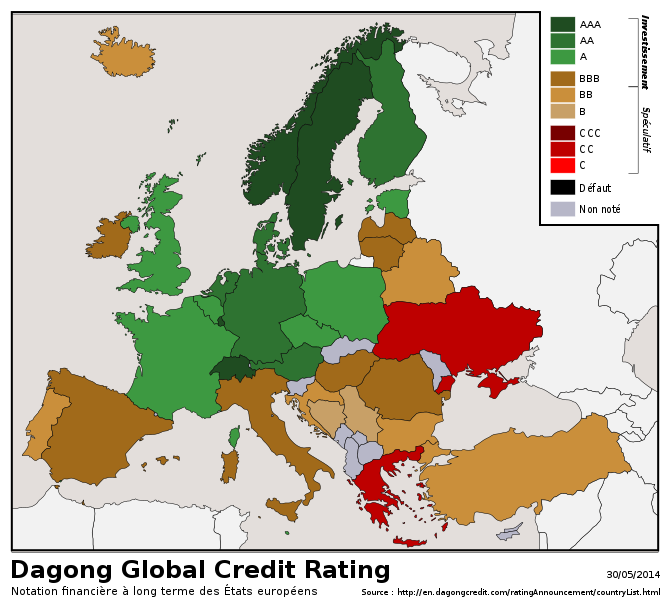

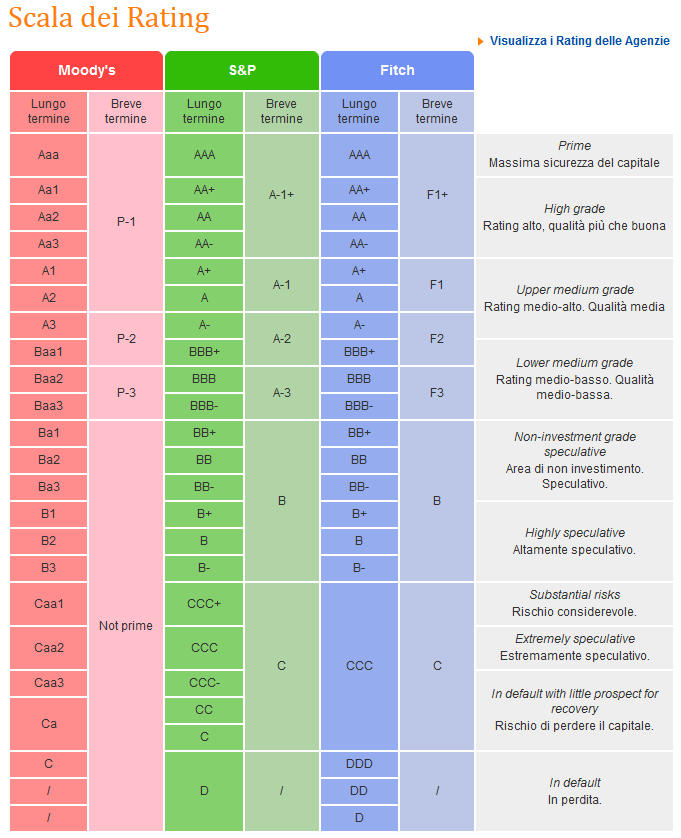

«There are a number of reasons EU’s social bond was in such high demand. For one, it carries the bloc’s AAA credit rating»

«A 14-times-oversubscribed sustainable debt offering also indicates a market that’s structurally underserved»

«This, to me, is an unsustainably low supply of sustainable debt. It creates the possibility that buyers will take their debt appetites elsewhere, no matter how green or sustainable their intentions»

«Sustainable debt issuance exceeded $560 billion last year, and has already reached $460 billion and beyond in 2020»

«Right now, almost all sustainable debt is B-rated or higher, meaning that its issuers are generally seen as low credit risks»

«At much greater scale, though, we should expect to see a wider range of credit ratings»

«bundles of speculative-grade loans, sliced into different tranches, with the lower-rated portions suffering the first losses to protect payments to those invested in the top layer»

«A much bigger market might give some investors pause, as over-securitization was a major part of the 2008-9 global financial crisis»

* * * * * * *

Cerchiamo di sintetizzare, anche a costo di essere molto riduttivi.

– Questi ‘social bonds’ dell’Unione Europea hanno ricevuto una richiesta quattordici volte superore all’offerta perché emessi da una entità con rating tripla A: AAA.

– Tuttavia la massa dei ‘social bonds’ è emessa da entità con rating ben inferiore, il cui mercato subirà per forza di cose la concorrenza delle emittenti con rating elevati

«A much bigger market might give some investors pause, as over-securitization was a major part of the 2008-9 global financial crisis»