Giuseppe Sandro Mela.

2018-08-12.

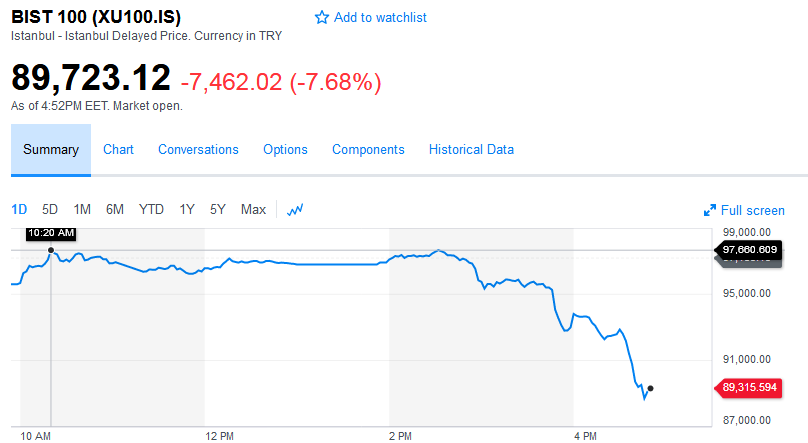

Le avvisaglie della terza guerra mondiale si stanno preannunciando con cospicui sommovimenti dei sistemi economici e finanziari.

Per l’economia del presente discorso, alcuni elementi sembrerebbero essere di particolare interesse.

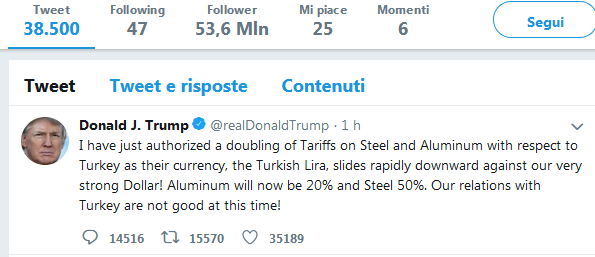

Trump. Executive Order EO13846. Della vera novità nessuno ne parla.

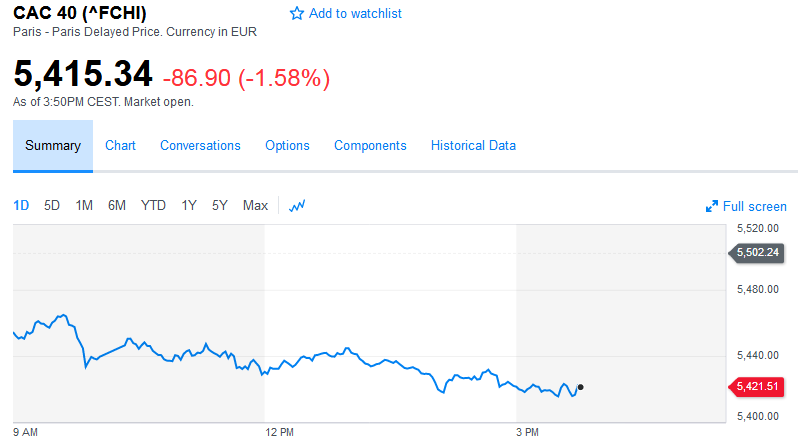

Trump. Colpire l’Europa attraverso la Turkia. Knockout.

La Voce del Padrone. Tornate nei ranghi!

*

Se sia del tutto comprensibile l’anelito di un governante di preservare con cura l’identità e la sovranità nazionale, altrettanto ragionevole sarebbe il dover considerare la propria nazionale nei rapporti culturali, politici ed economici con tutte le restanti nazioni.

Un governante saggio sa bene come si debba addivenire ad accordi, ove ciascuna delle parti conceda, e nel contempo ottenga, qualcosa. L’ingordigia e l’orgoglio possono diventare armi di autodistruzione temibili.

Se sicuramente sono esistiti, e ne esistono tuttora, politici di razza quali Mr Charles-Maurice de Talleyrand-Périgord, Principe di Benevento, capace di tener il piede in ventisette scarpe diverse lasciando tutti contenti e soddisfatti, è anche altrettanto vero come la gran parte dei politici siano omuncoli piccoli piccoli, di lega vilissima.

In politica, la chiarezza da sempre buoni frutti, mentre le ambiguità si pagano spesso a caro prezzo.

La storia insegna come sia meglio avere al governo un governante anche del tutto spudorato, piuttosto che un imbecille, oppure una persona ragionevole ma accecata dalla sua superbia.

*