Giuseppe Sandro Mela.

2017-12-20.

«Today we are giving the people of this country their money back. This is their money after all!»

*

«Republicans barreled toward a massive victory Tuesday with the House and Senate voting to approve a $1.5 trillion tax cut, notching the first major legislative win of the Trump presidency.

In one bill, Republicans said they were checking off three major parts of their agenda: The massive tax overhaul is coupled with a repeal of Obamacare’s individual mandate and authority to drill for oil in a remote Alaska refuge» [The Washington Times]

*

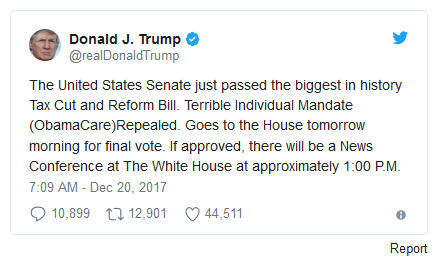

«In a vote in the early Wednesday morning hours, the Senate approved the final version of the first overhaul of the US tax code in more than 30 years, handing President Donald Trump and congressional Republicans their most significant legislative victory of 2017» [Cnn]

*

«The House earlier approved the bill comfortably, 227 to 203. In the Senate, it was 51 to 48.»

*

«Corporate taxes will be set at 21%, instead of the current rate of 35%. ….

– Less inheritance tax

– An expanded child tax credit

– Lower taxes on overseas profits»

*

«Last week, the finance ministers of Europe’s five biggest economies — Germany, France, the UK, Spain and Italy — wrote an anxious letter to their American colleague, US Treasury Secretary Stephen Mnuchin, and copied it to all senior Republican politicians in the Congress and Senate.»

*

«The United States is Europe’s single most important trade and investment partner,” the finance ministers wrote. “It is important that the U.S. government’s rights over domestic tax policy be exercised in a way that adheres with international obligations to which it has signed-up. The inclusion of certain less conventional international tax provisions could contravene the US’s double taxation treaties and may risk having a major distortive impact on international trade»

*

«The European finance ministers argued that this measure would break WTO rules because it levies a tax only on foreign goods and services, not on the equivalent domestically produced goods and services»

*

«the Senate bill featured a “base erosion and anti-abuse tax” (BEAT) provision. “Base erosion,” or more properly “base erosion and profit shifting” (BEPS), is a technical term referring to various accounting schemes corporations use to legally shift profits from where they’re earned, to ultra-low tax jurisdictions.»

*

«some of the proposed measures could constitute unfair trade practice and may discourage non-US financial institutions from operating in the US»

*

«when US companies earn income outside the US via licensing fees, those fees would be taxed at a reduced corporate tax rate of 12.5 percent (compared to a proposed 21 percent federal tax rate for other corporate profits)»

*

«the US will go from being a high-tax to a low-tax country. Until now, the tax burden on companies has been significantly higher in the US, with a tax rate of 39 percent, compared to 30 in Germany or 34 in France»

*

«However, countries like Ireland or the Netherlands already do that too, …. Therefore, the indignation of EU finance ministers is not very credible on this particular point.”»