Giuseppe Sandro Mela.

2017-01-17.

«Cold weather, heavy snowfall boosted electricity consumption»

*

«Southeast European nations are halting exports to neighbors»

*

«Greece halted electricity outflows on Wednesday and Bulgaria plans to stop all power exports from Friday.»

*

«Electricity for next-day delivery sold at 77.70 euros ($83) a megawatt-hour on the Seepex exchange, about half Tuesday’s levels but still almost double the price in Germany, the European benchmark»

*

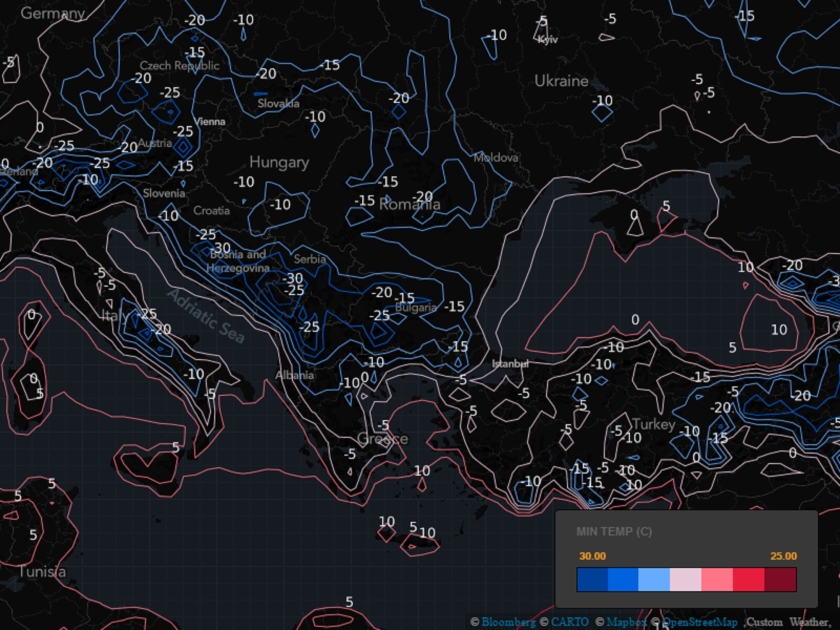

«Hydroelectric production plummeted in the Balkans as temperatures fell as low as minus 20 degrees Celsius (minus 4 Fahrenheit) and parts of the Danube river were almost entirely covered with ice»

*

«Romanian Energy Minister Toma Petcu warned that the country’s two major coal producers have reserves that would last only four days if consumption remains at peak levels»

*

«The prolonged cold snap exposed the weakness of southeast Europe’s power markets, which should in theory have unrestricted flows»

*

«A former Australian industry minister, Ian Macfarlane, claimed at a uranium industry conference that the only serious alternative way that baseload power can be produced is by hydro and nuclear» [Fonte]

2 pensieri riguardo “Energia. L’inverno mette in crisi il sud-est europeo.”

I commenti sono chiusi.