Giuseppe Sandro Mela.

2016-10-08.

Gli articoli allegati fanno parte integrante del testo. Senza averli letti con cura sarebbe impossibile capire questo articolo. Questa è la seconda parte. Qui la prima:

Deutsche Bank. Mai mettere i tedeschi spalle al muro. 2016-10-07

Deutsche Bank è una banca nominalmente tedesca, ma nei fatti è una vera e propria multinazionale del credito. Non è una realtà solo tedesca, né solo europea.

Non saperla o volerla comprendere sotto questa ottica porterebbe invariabilmente a giudizi errati.

Non solo.

L’Occidente negli anni sessanta rendeva conto di più del 90% del pil mondiale, ma oggi arriva a stento a superare il 40%. Ed è anche fortemente diviso. Le forze che erano predominanti un tempo in Occidente, seguono il suo destino e quindi valgono sempre meno anche esse. Non che i Rothschild oppure i Rockefeller non contino più nulla: sono però severamente ridimensionati, relegati in secondo piano.

Non solo, ma una cosa era Mayer Amschel Rothschild, il banchiere del Langravio del Hesse-Kassel, ed una totalmente differente i suoi pronipoti: la teoria dell’evoluzione è chiaramente disconosciuta. Si sono involuti, non evoluti.

*

Il cuore del problema è questo:

«Qatari and allied investors are considering bolstering Deutsche Bank with fresh capital by taking a stake of 25 percent in Germany’s biggest lender»

Si rimane attoniti e stravolti dal fatto che la gente, anche alcuni abbastanza colti, non riescano a comprendere come siano mutati i tempi. Gli arabi del Qatar sono gli attori di questo dramma.

L’Occidente sta tramontando: si sta suicidando. Si sta estinguendo, e non solo fisicamente.

*

«In June 2014, HBJ acquired 80% of Heritage Oil, which was listed as a London exploration and production company»

*

«It was reported that HBJ bought Banque Internationale à Luxembourg and KBL European Private Bankers via Precision Capital, making one of the largest banking groups in Luxembourg»

*

«Now, investors from Qatar, who already own some 10 percent of Deutsche Bank, are considering taking control»

*

«A partner who explicitly supported Jain’s strategy of establishing the company as the last globally important European investment bank»

*

«HBJ cousins are considering propping up the bank with a fresh capital infusion and purchasing a blocking stake of 25 percent together with other investors».

*

«Qatari and allied investors are considering bolstering Deutsche Bank with fresh capital by taking a stake of 25 percent in Germany’s biggest lender»

* * * * * * *

Adesso la situazione dovrebbe essere alquanto più chiara e spiegare anche la violenta reazione tedesca.

Deutsche Bank. Mai mettere i tedeschi spalle al muro. 2016-10-07

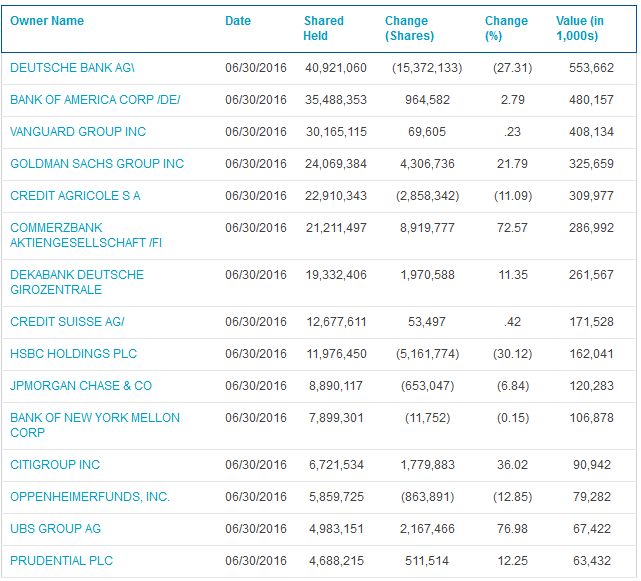

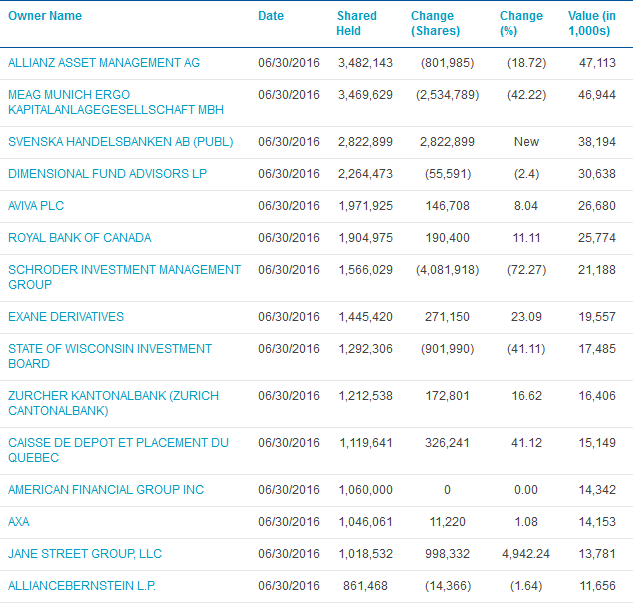

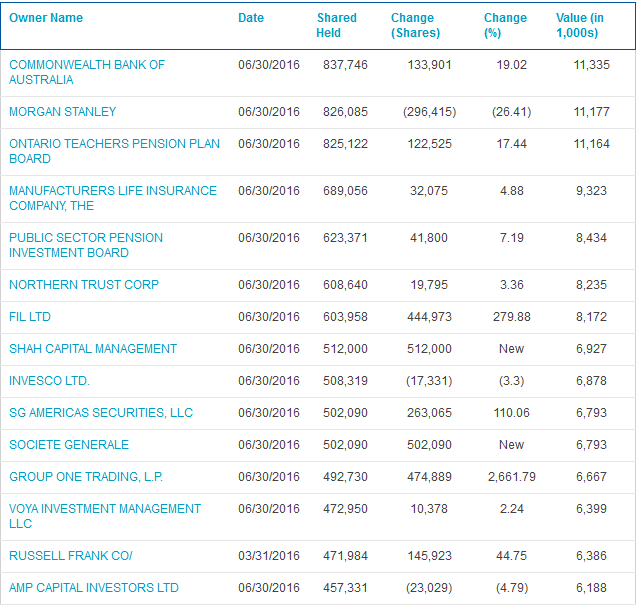

Ma gli altri azionisti, cosa vorranno fare?

Il problema non è tanto la situazione finanziaria ed economica di Deutsche Bank, quanto piuttosto chi la controlla e la controllerà.

«The key question as to the future of Deutsche Bank is what the sheikh wants to do with it»